EA Overview

| Logic Overview | Trend-following |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | No |

| Trading Pairs | GBPUSD |

| Timeframes | 1H |

| Developer | Bogdan Ion Puscasu |

Forward Test Analysis (as of December 2025)

Overview of the Official Signal and Growth

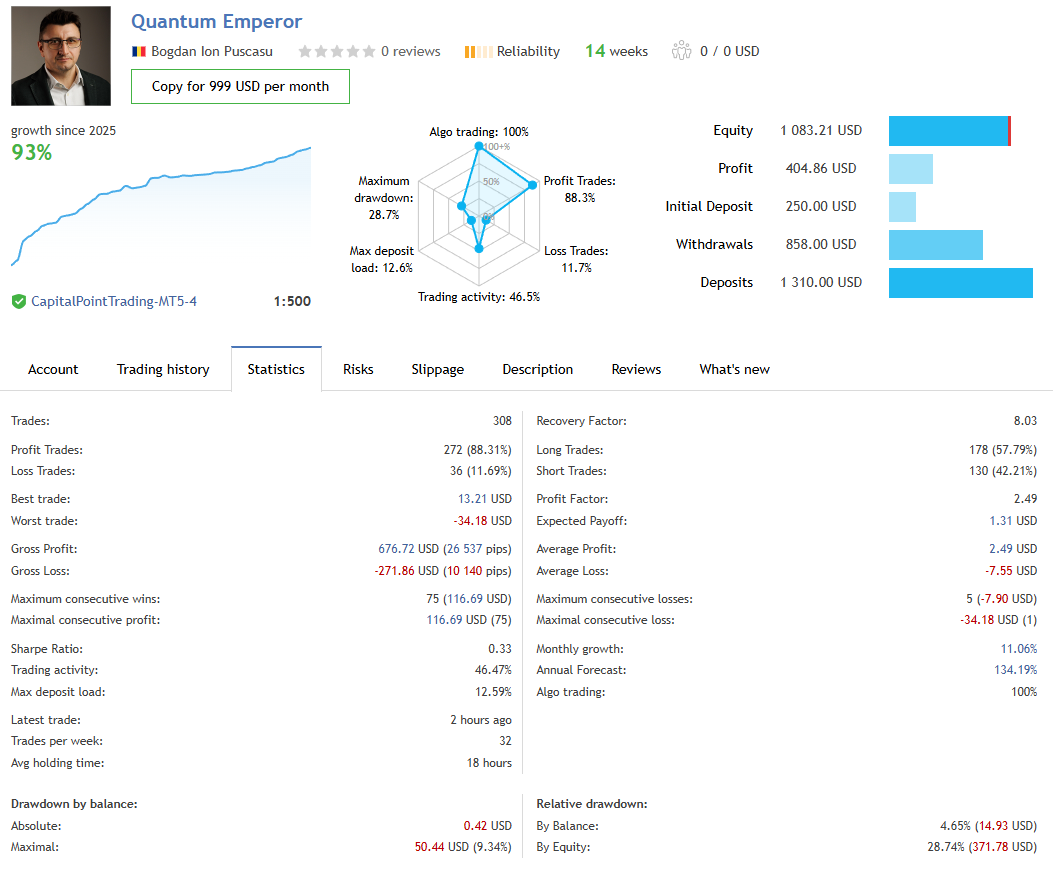

As of the time of writing (December 2025), the official Quantum Emperor MT5 signal has about 14 weeks of live performance.

It started with an initial balance of USD 250, and after several deposits and withdrawals, the current equity stands at around USD 1,083, with cumulative profit of about USD 404 and total growth of approximately +93%.

There have been 308 trades in total, with an average of around 32 trades per week and an average holding time of about 18 hours, which is more of an H1 swing-style approach than pure scalping.

Monthly growth is around +11%, and the annualized figure is about +134%, which makes the forward performance look very attractive if you only look at the numbers.

High Win Rate but Poor Reward-to-Risk Structure

Looking at the forward statistics, there are 272 winning trades (about 88%) and 36 losing trades (about 12%), which is an extremely high win rate.

On the other hand, the average profit per trade is +USD 2.49, while the average loss is -USD 7.55, giving a reward-to-risk ratio of roughly 1:3, which is quite poor.

This is not a “cut losses quickly and let profits run” style, but rather a classic “small profits, bigger losses” system, where small wins are accumulated and occasionally offset by larger losing trades.

The profit factor of 2.49 is high, but it is mainly supported by the high win rate. The system always carries the risk that a single losing trade will wipe out the profit from several winners.

Risk Seen from Drawdown and Margin Usage

In terms of drawdown, the maximum balance drawdown is about 9.3% (around USD 50), which looks relatively modest, but the maximum equity drawdown reaches about 28.7% (around USD 372).

The maximum deposit load is 12.59%, so margin usage itself is not extreme, but it shows that equity can drop sharply when floating losses accumulate.

The fact that “margin usage is not very high, yet equity still suffers drawdowns of nearly 30%” is an important clue to understanding this EA’s risk structure.

If you increase the lot size or run it under strict drawdown limits such as those used by prop firms, you need to carefully estimate how much impact a single losing streak can have on the entire account.

Current Forward Assessment: Impressive Numbers, but Track Record Still Short

Based on the statistics alone, a win rate of about 88%, profit factor of 2.49, growth of +93%, and monthly growth of +11% look very impressive.

However, the live period is still only about 14 weeks, and multiple deposits and withdrawals have been made along the way, so we cannot yet judge whether the same performance will continue long term or how deep the drawdown might become during major trend changes.

At this point, we must consider the possibility that “a high-win-rate EA with poor reward-to-risk just happened to fit the market conditions over the past few months.”

For that reason, this article treats the forward results only as a “provisional assessment as of December 2025,” and in the next section we examine the longer-term risk-return balance using a 20-year backtest.

Backtest Analysis

Test Conditions and Environment

In this article, I ran my own backtest to check the long-term risk, rather than relying only on the official forward results.

The test conditions were as follows:

- Period: 1 January 2005 – 28 November 2025 (about 20 years of data)

- Symbol: GBPUSD

- Initial balance: USD 10,000

- Lot size: fixed 0.01 lot

- Other settings: default

- Spread: 10 points

The history quality is shown as 99%, so the data itself is sufficiently reliable for testing.

Trades Only Start in 2015

Although the test period is set to start in 2005, actual trades do not begin until 2015.

From the graph, there are almost no entries between 2005 and 2014, meaning that in practice the backtest only covers “about 10 years from 2015 onward.”

It is highly likely that the EA is coded to begin trading from a specific date, or that its logic only operates in later years, which raises concerns that unfavorable market regimes might have been intentionally excluded.

Ideally, we would like to evaluate robustness across all major volatility events, such as the 2008 financial crisis, the pound crisis, and the COVID-19 shock, but this particular backtest alone does not allow us to fully assess that.

Overview of Profit and Trade Statistics

In this backtest, starting from USD 10,000, the final net profit is around USD 840.

There are 3,128 trades in total, which is a sufficient sample size, but “+USD 840 over about 10 years with a fixed 0.01 lot” is, frankly, a rather underwhelming performance.

Looking more closely at the stats, winning trades account for over 90% of the total, so just like in the forward test, the win rate is very high. However:

- Average profit: around +USD 1 per trade

- Average loss: around -USD 10 per trade

This clearly shows a poor reward-to-risk profile where a single loss can wipe out the profit from several winning trades.

The profit factor is 1.34, which is positive, but this number is just barely supported by the high win rate. Applying this behavior directly with higher lot sizes would require a very cautious risk approach.

Risk Seen from the Absolute Equity Drawdown

The maximum balance drawdown is around USD 150, which is not very large, but the maximum equity drawdown (account value including floating P/L) falls to about USD 250.

On the graph, the blue balance line climbs fairly smoothly, while the green equity line repeatedly drops in sharp vertical spikes, showing that many trades hold sizeable floating losses and wait for recovery over time.

Rather than focusing on percentage drawdowns, which depend on balance and lot size, it is more useful to look at the absolute figure: with a 0.01 lot, equity falls by about USD 250. If you increase the lot size, this amount scales up directly and can quickly become a serious hit to the account.

Risks and Limitations Revealed by the Backtest

In summary, the backtest reveals the following key points:

- Even though the test period starts in 2005, real trading only occurs from 2015 onward, effectively halving the true testing horizon.

- Net profit of +USD 840 over around 10 years with a fixed 0.01 lot is a small return for the risk taken and cannot be called a strong backtest result.

- The equity drawdown repeatedly sinks deeply, clearly indicating a high-risk trading style that often carries substantial floating losses over long periods.

While the forward performance is not bad at the moment, the backtest alone does not support the impression of “an EA that can steadily grow capital over the long term.”

In particular, the effective narrowing of the test period and the relatively heavy equity drawdowns for such poor reward-to-risk are the main risk factors to be wary of when considering real-money operation.

Trading Logic and Risk Characteristics

“Split Entry” in the Direction of the Trend

According to the developer, Quantum Emperor MT5 is a trend-following EA that “does not use grid or martingale.”

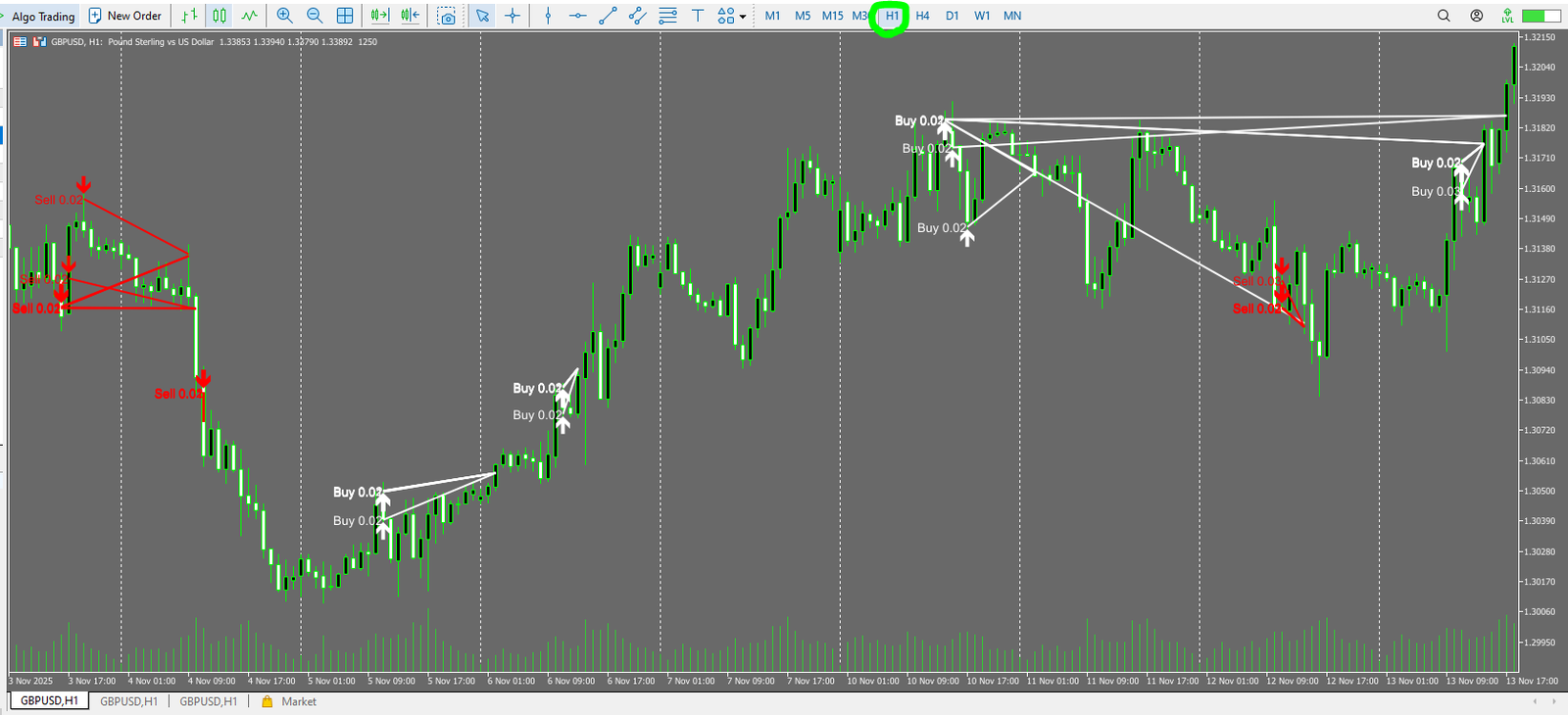

In practice, it trades in the direction of the trend on the H1 chart and splits a single signal into several smaller positions.

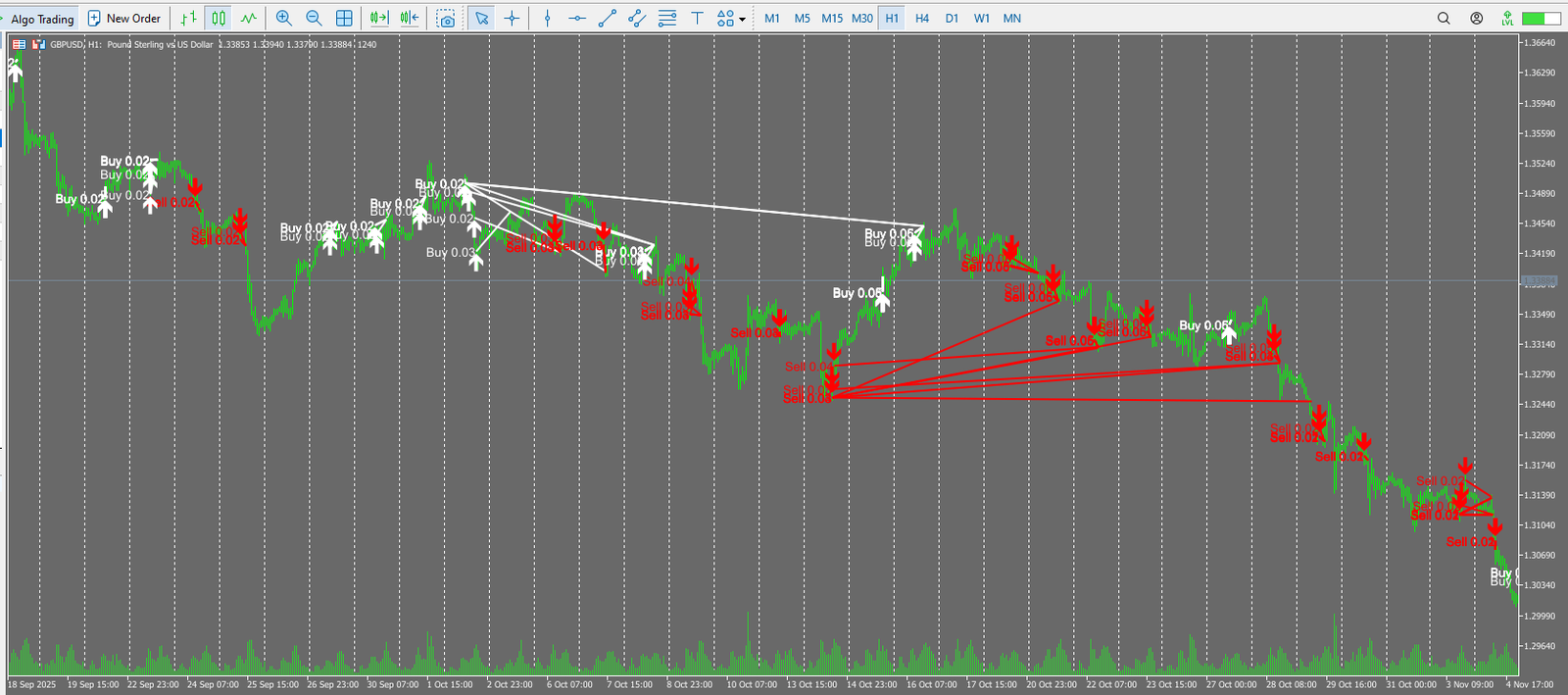

In the forward trade history chart, white arrows mark Buy orders and red arrows mark Sell orders, and you can clearly see multiple 0.02-lot positions opened at almost the same price levels.

This structure of “opening multiple positions at once” allows the EA to stack up many small profits when the market moves as expected.

“Small Profits, Big Losses” Risk Profile

Although the developer emphasizes that the system uses “no grid, no martingale,” the actual trade history shows a risk profile that clearly fits the “small profits, big losses” pattern.

For both Buy and Sell, profits are generally taken quickly, with small winning trades of a few dozen pips occurring in succession, while losing positions are not cut immediately and often remain open for a long time.

On the chart, short arrows show quick profit-taking, whereas losing positions are connected by long lines, extending across many bars until price finally returns.

As a result, the win rate is high, but from time to time there are trades where a single stop loss wipes out the accumulated profit from many small winners.

No Grid/Martingale, but Prone to Large Floating Losses

The lot size is basically fixed, and it does not increase the lot size geometrically as price moves against the position, as in a classic martingale.

Nor does it behave like a pure grid EA that keeps adding positions at fixed intervals without limit; entries are still based on trend-following signals.

However, in reality, the behavior is “enter trend-direction trades in multiple parts, and if the market moves against them, hold the positions for a long time and gradually offset them with profits from later trades.” This makes it inherently prone to large floating losses.

The big dips in the equity curve appear to stem from this combination of slow stop-loss execution and long-term position holding.

Summary: High Win Rate with a Time-Dependent High-Risk Structure

Overall, Quantum Emperor MT5 runs on a logic of “split entries in the trend direction → accumulate small profits → hold losing positions for a long time.”

It does not snowball lot size like a grid or martingale system, but it is still a “small profits, big losses” EA with significant equity drawdowns.

The more you increase the lot size, the heavier the impact of those occasional large losses becomes, so it is crucial to understand both the high win rate and the magnitude of risk as a package before using this EA.

Overall Evaluation and Conclusion

Quantum Emperor MT5 is an EA that “does not use grid or martingale, yet still has a high win rate, small profits, and a tendency to hold large floating losses.”

The forward performance alone looks attractive, but a closer look at the long-term backtest and trade history reveals several risk factors that cannot be ignored.

Key Findings from This Review

- The official forward signal shows more than +90% growth in about 14 weeks, with a win rate of around 88% and a profit factor in the 2.4 range – numerically very strong.

- However, the roughly +10% monthly growth is sustained by the combination of “small profits, big losses + high win rate,” meaning occasional large losses can give back a big portion of accumulated profit.

- In my verification backtest, even though the period is set from 2005, trades only start from 2015, suggesting that unfavorable market conditions may have been excluded.

- With a fixed 0.01 lot over about 10 years, the net profit is around USD 840, which is modest relative to the risk taken.

- While the balance curve is smooth, the equity curve shows frequent sharp drops, indicating many periods where large floating losses are held for a long time.

- The logic uses split entries in the trend direction, quick profit-taking, and slow stop-losses, relying on time to escape adverse moves.

Who This EA Is and Isn’t For

- Suitable for:

Traders who want to test a high-win-rate style with small lots and small accounts, mainly for short- to medium-term forward evaluation. - Not suitable for:

• Traders who cannot tolerate large equity drawdowns

• Those who want to run the EA under strict prop-firm drawdown rules

• Traders focused on low-risk, long-term capital growth

Final Verdict (as of December 2025)

Based solely on the current forward results, Quantum Emperor MT5 may look like a very strong EA, but when we consider the long-term backtest and the depth of equity drawdowns, it seems prudent to be cautious about trusting it with large capital for long-term operation.

If you decide to use it, it would be wise to limit it to small lots in a sub-account or test account and avoid relying on this EA for your entire portfolio.

Future forward performance may change the evaluation, but as of December 2025, I would categorize it as “an EA with a high win rate and significant risk – one that traders will either like or dislike depending on their risk tolerance.”

It does not use grid or martingale, but it is a typical “small profits, occasional big loss” style with a high win rate and long-lasting floating losses. Even with a fixed 0.01 lot, the equity dips are deep, and if you increase the lot size, a single stop loss can hit the account very hard. This is an EA where feeling safe about the short-term win rate and scaling up too much is dangerous.