EA Overview

| Logic Overview | LLM-connected |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | Yes |

| Trading Pairs | XAUUSD |

| Timeframes | 30M |

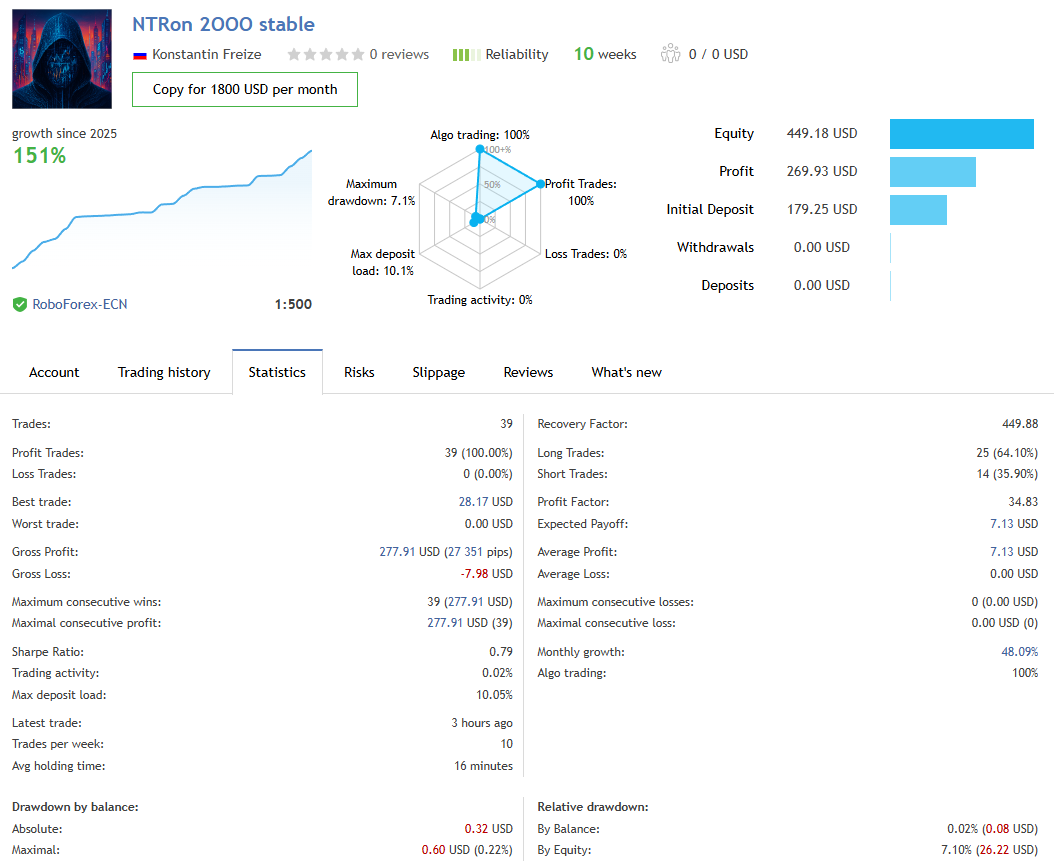

Current Forward Test Analysis (NTRon 2OOO stable)

In this section, we summarize the forward test results of the official MQL5 signal “NTRon 2OOO stable” as of December 10, 2025. The signal has been live for only about 10 weeks, so the track record is still short, but we can get a sense of the current risk–return profile.

Overview of Period and Returns

The signal is running on RoboForex-ECN with 1:500 leverage. The equity has increased from an initial balance of 179.25 USD to 449.18 USD, for a profit of +269.93 USD (about +151%). The tracking period is about 10 weeks with 39 trades, and at this point every trade has closed in profit, resulting in 39 wins, 0 losses, and a 100% win rate.

The Profit Factor is 34.83, and the average profit per trade is 7.13 USD—exceptionally high figures for such a short-term signal. However, these numbers may simply reflect a strong initial phase, so it remains to be seen whether they can be sustained over the long run.

Drawdown and Risk Metrics

From a risk perspective, the maximum drawdown by balance is 0.22% (0.60 USD), which is virtually negligible. On the other hand, the more realistic maximum drawdown by equity is 7.10% (26.22 USD), showing that there were moments where the account held a non-trivial floating loss.

The maximum deposit load is 10.1%. Given the 1:500 leverage, this suggests the EA is currently trading with relatively small position sizes. The recovery factor stands at about 449.88, an extremely high value that primarily reflects the combination of small drawdowns and large profits typical of the early phase of a successful signal.

Trade Frequency and Style

According to the statistics, the EA takes about 10 trades per week and the average holding time is 16 minutes. This is not ultra-high-frequency scalping, but rather a style somewhere between short-term day trading and very short swing trading. The split between long and short positions is 25 longs and 14 shorts, slightly favoring longs but not excessively skewed in one direction.

From the current data alone, NTRon 2OOO appears less like a hyper-active scalper and more like a short-term trading EA that selectively enters trades, aiming to combine a high win rate with low drawdowns.

Strengths and Caveats Seen in the Forward Results

Although the sample is small—only 10 weeks and 39 trades—the combination of 100% win rate, PF above 34, equity drawdown around 7%, and deposit load around 10% suggests that, at least so far, the EA is being run with fairly conservative risk. The fact that it achieves this while delivering a monthly growth rate of about 48% is a major attraction.

On the other hand, such “too clean” performance is statistically more likely to occur over short periods. Because there has not yet been a single losing trade, we still have no real-world data on the size of individual losses or how severe a losing streak might be. For now, the results should be viewed as a snapshot of a strong early phase, and traders should remain cautious rather than blindly trusting the signal.

This forward record serves as a starting point. In the following sections we examine the backtest and the underlying logic to judge whether the EA is robust enough for long-term use.

20-Year Backtest Analysis (Validation with 0.01 Lots)

In this section, I summarize the results of my own backtest using the MT5 Strategy Tester to evaluate the risk and return characteristics of NTRon 2OOO. To understand the EA’s long-term behavior beyond the forward results, I tested it on about 20 years of XAUUSD data.

Backtest Conditions

The backtest was conducted under the following conditions:

- Period: January 1, 2005 – November 28, 2025 (about 20 years of data)

- Symbol: XAUUSD

- Initial balance: 10,000 USD

- Lot size: fixed 0.01 lot

- Other settings: default

- Spread: 40 points

Equity Curve and Total Profit

The equity curve rises steadily from 2005 to 2025, with almost no deep valleys or V-shaped recoveries. Starting from 10,000 USD, the strategy ends with a total net profit of +11,219.63 USD, bringing the balance to just over 21,000 USD.

The Profit Factor is 4.29, and the Recovery Factor is 66.34, which are quite high for a long-term backtest with a fixed 0.01 lot. The history quality is reported as 98%, suggesting that the test conditions are reasonably reliable.

Drawdown and Risk in Absolute Terms

Because drawdown ratios depend heavily on balance size and leverage, we focus here on the absolute dollar amounts:

- Maximum drawdown by balance (closed trades): 144.02 USD

- Maximum drawdown by equity (including floating P/L): 169.13 USD

- Total loss over the worst losing streak of 5 trades: -96.82 USD

With a fixed 0.01 lot and an initial balance of 10,000 USD, even the worst floating loss stays around 170 USD, which is quite contained relative to the lot size. However, if the lot were increased tenfold to 0.1, these drawdown amounts would also scale up by roughly a factor of 10. At small lot sizes, the EA is not the type that devastates an account with a single trade or losing streak, but ramping up the lot size can quickly change that picture.

Trade Frequency and Win Rate

The system executed 3,572 trades (7,144 deals), of which 3,416 were winners and 156 were losers. The win rate is about 95% for both long and short positions.

- Largest winning trade: about 63 USD

- Average winning trade: about 4.28 USD

- Largest losing trade: about -24.70 USD

- Average losing trade: about -21.89 USD

- Maximum winning streak: 204 consecutive wins (+897 USD)

- Maximum losing streak: 5 consecutive losses (-96.82 USD)

These numbers indicate that NTRon 2OOO earns money by taking small profits very frequently, with occasional losses around 20 USD. Although the loss per trade is somewhat larger than the average profit, the very high win rate produces a gently rising equity curve overall.

Strengths and Caveats from the Backtest

Under the 20-year, 0.01-lot conditions, NTRon 2OOO’s maximum floating loss stays under 200 USD and even the worst 5-trade losing streak costs under 100 USD. As long as lot sizes remain small, the absolute size of drawdowns is relatively easy to control. However, the very high win rate also means that the impact of each losing trade cannot be ignored.

If you increase the lot size, the cost of a single loss or a 5-trade losing streak jumps sharply. It is therefore important not to be lulled into complacency by the smooth backtest curve, and to carefully determine how far you can scale up the lot size given your account balance and acceptable loss. Viewed together with the forward results, the EA currently looks like one that can build profits fairly steadily under low-lot conditions, but strict position sizing remains essential.

Trading Logic and Risk Characteristics

In this section, we organize NTRon 2OOO’s trading logic and risk characteristics based on the developer’s public description and the actual forward and backtest results. All observations are based on information available as of December 10, 2025.

Core Concept as Described by the Developer

According to the developer, NTRon 2OOO combines two main components into a “hybrid strategy”:

- News sentiment analysis: AI analyzes U.S. macroeconomic releases and FOMC-related news headlines to determine whether the news is positive or negative for the U.S. dollar. Bullish USD news biases the EA toward selling gold, while bearish USD news biases it toward buying gold.

- Order book (DOM) imbalance simulation: Tick data is used to reconstruct a pseudo order book, estimating where liquidity is clustered and where large orders sit. The EA attempts to distinguish fake liquidity from genuine “walls” and uses this information to decide entry and exit timing.

By combining these two components, the EA aims to consider both the macro direction driven by news and the micro timing informed by order-book imbalance, thereby reducing false signals when entering trades.

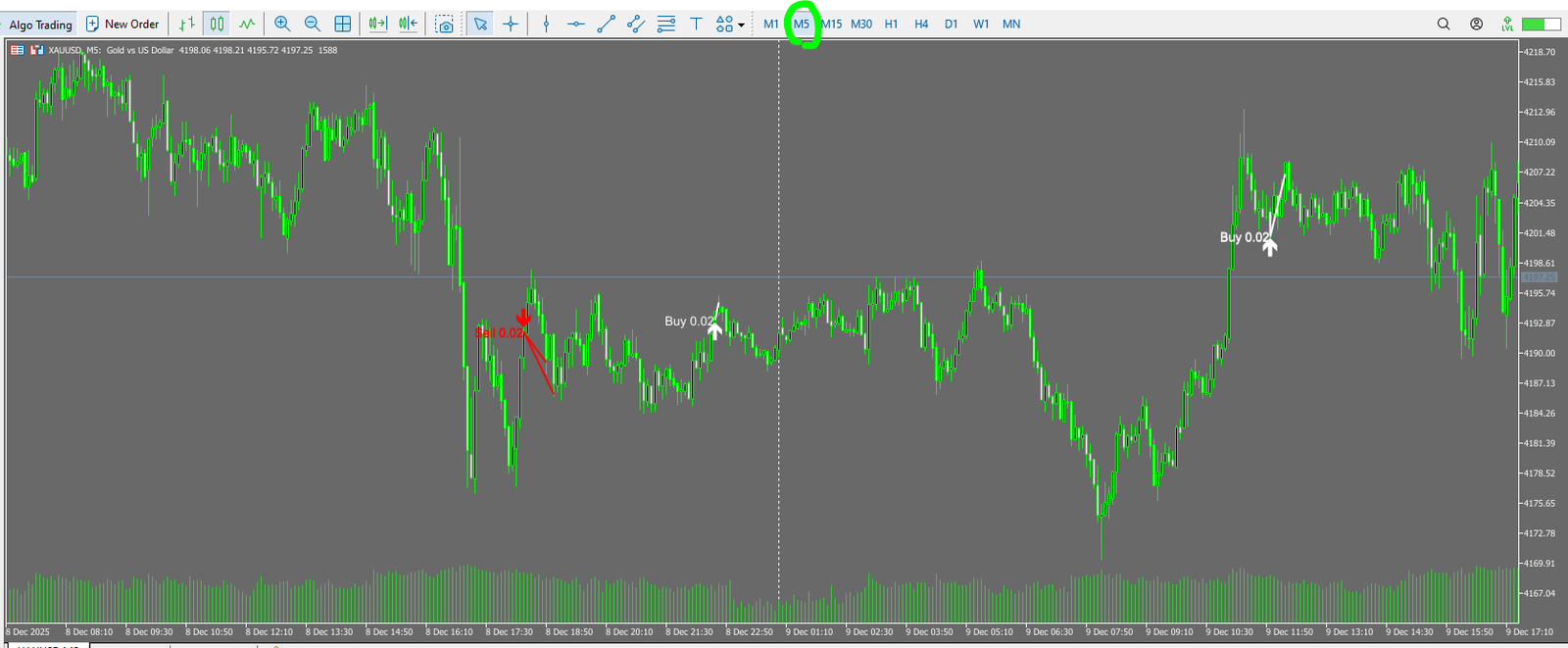

Entry Style Seen in the Forward Trades

When the forward trades are plotted on the chart, white arrows mark buy entries and red arrows mark sell entries. This visualization shows that NTRon 2OOO is a small-target scalping EA that tries to capture short-term momentum.

On the M5 chart, many entries appear after sharp, news-driven moves when the direction is clear. There is no behavior resembling repeated averaging down against the trend. The EA sometimes adds positions in the same direction, but the spacing between entries is relatively wide, so it does not behave like a classic grid system.

Trade Balance and Time Frame

On the H1 chart, the forward trades show mainly buy entries in uptrends and sell entries in downtrends, indicating a generally trend-following approach. Buys and sells are not heavily skewed in one direction; the EA takes both sides depending on news and market conditions.

The average holding time ranges from several tens of minutes to a few hours, placing the EA somewhere between short-term day trading and very short swing trading, rather than ultra-high-frequency scalping.

Stop Losses and Reward–Risk Profile

The backtest confirms that every trade has a clearly defined stop loss, and the EA does not postpone losses using grid or martingale techniques. There is no behavior where it keeps averaging down or doubling lot sizes while holding large floating losses; losing trades are cut according to predefined rules.

Closer inspection of the statistics reveals:

- Average profit per trade: a few dollars (relatively small)

- Average loss: significantly larger than the average profit

- Win rate: around 95%, very high

This is the hallmark of a “small-profit, larger-loss, high-win-rate” reward–risk profile. The EA builds equity by stacking many small wins, occasionally giving back a chunk of profit when a stop loss is hit.

Overall Risk Characteristics

Because it does not use grid or martingale, the EA is less likely to blow up an account in a short time. In the backtest with a fixed 0.01 lot, the largest floating loss and worst losing streak stay in the 100–200 USD range, so with small lot sizes, the monetary size of drawdowns is relatively manageable.

However, the small-profit, larger-loss structure means that losing streaks still hurt. Thanks to the high win rate, the equity curve looks smooth, but if you trade with oversized lots, just a few stop losses can significantly damage your account. So far, neither the backtest nor the forward test has shown a major collapse, but traders should not assume that a “high-win-rate scalper” is automatically safe. It is crucial to set clear rules for position sizing and maximum acceptable loss in advance.

Overall Evaluation and Conclusion

Summary as of December 10, 2025

- NTRon 2OOO is a gold-only EA with a fairly unique concept that combines news sentiment with simulated order-book analysis.

- The forward test shows +151% over about 10 weeks and 39 trades, with only small floating drawdowns so far, giving the impression of “steady growth with small lots.”

- The 20-year backtest (0.01 lots) generates about +11,000 USD of net profit with maximum floating losses around 170 USD, showing no signs of catastrophic breakdown.

- The EA does not use grid or martingale and employs proper stop losses, but its design is a typical high-win-rate scalper with small profits and larger losses.

Advantages

- Single-entry logic that does not rely on averaging down or increasing lot sizes, making sudden account blow-ups less likely.

- With 0.01 lots, the absolute size of drawdowns is only in the 100–200 USD range, making risk management easier when trading small.

- Because it combines news and liquidity information, it may capture market context better than EAs based purely on price patterns.

Disadvantages and Cautions

- The forward sample is still very small—about 10 weeks and 39 trades—so there is no guarantee that the current strong performance will continue.

- Although the win rate is high, each stop loss is relatively large, so losing streaks can inflict noticeable damage (small-profit, larger-loss structure).

- Increasing the lot size proportionally increases the size of floating losses and the cost of a 5-trade losing streak, so it is risky to scale up just because the backtest curve looks smooth.

Who This EA Suits

- Traders who want to avoid grid and martingale systems but still trade gold with a short-term strategy.

- Those who are comfortable with a style that steadily accumulates small profits and can psychologically accept the occasional larger stop-loss hit.

- Intermediate to advanced traders who can define their own position-sizing and withdrawal rules and manage risk over the long term.

Final Thoughts

Based on the current forward and backtest data, NTRon 2OOO is an attractive option as a high-win-rate scalper that does not rely on grid or martingale techniques. However, given the short forward history and the inherent small-profit, larger-loss structure, it should not be taken for granted as “safe.”

If you decide to use it, a prudent approach would be to start with very small lots and a dedicated test account, observe how stop losses and losing streaks actually play out, and then gradually form your own judgment about its suitability for your risk tolerance.

This is a high-win-rate scalping EA that does not use grid or martingale and sets a stop loss on every trade. With a fixed 0.01 lot, the maximum floating drawdown stays around 170 USD, which is relatively modest. However, because the logic is “small profit, larger loss,” increasing the lot size also magnifies the impact of each stop loss. With small lots the risk is moderate, but with excessive leverage it quickly turns into a high-risk EA.