EA Overview

| Logic Overview | Trend-following |

|---|---|

| Martingale | Yes |

| Grid | Yes |

| Scalping | No |

| Developer | FOREX STORE |

Forward Test Analysis (as of 25 December 2025)

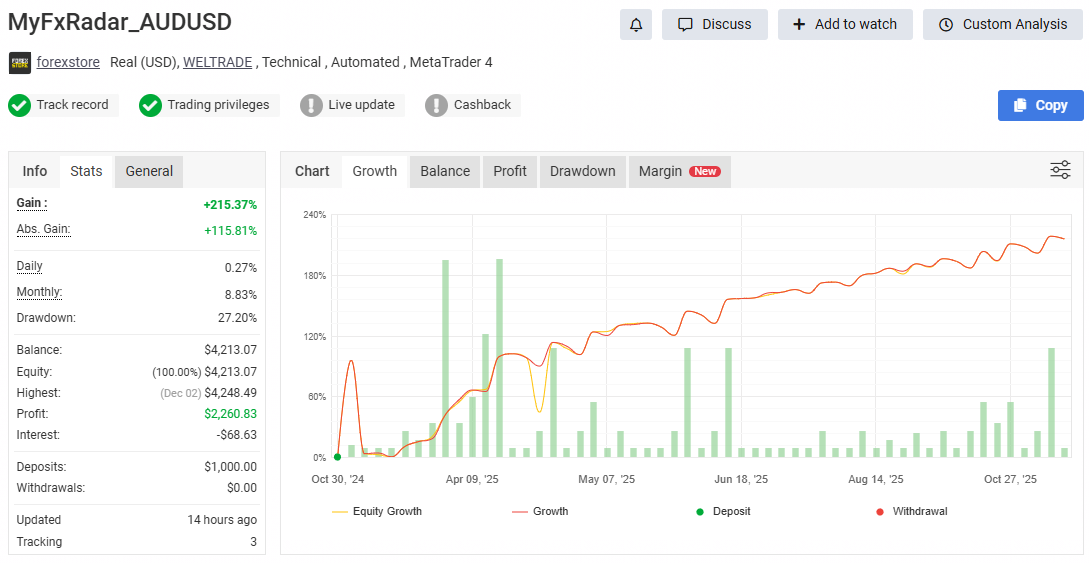

Overview of the Myfxbook Forward Results

As of 25 December 2025, the Myfxbook forward test for “MyFxRadar_AUDUSD” shows that an initial deposit of 1,000 USD has grown to a balance of around 4,200 USD. The total gain is about +215% with a maximum drawdown of roughly 27%. The monthly return is hovering around +8–9% on average, so at a glance it looks like a “solid EA that grows the account steadily.”

What the Equity Curve Tells Us

Looking at the equity curve, there is a sizable drawdown early in the test, after which the curve climbs upward relatively smoothly. This pattern is very common among grid/martingale EAs and the overall impression depends heavily on whether the account manages to survive the early phase.

Because the balance is now much larger, the same lot settings offer a wider buffer before the account blows up. In other words, this equity curve shows the results on an account that has already “grown up,” and the same settings on a small starting balance will not necessarily produce a similar curve.

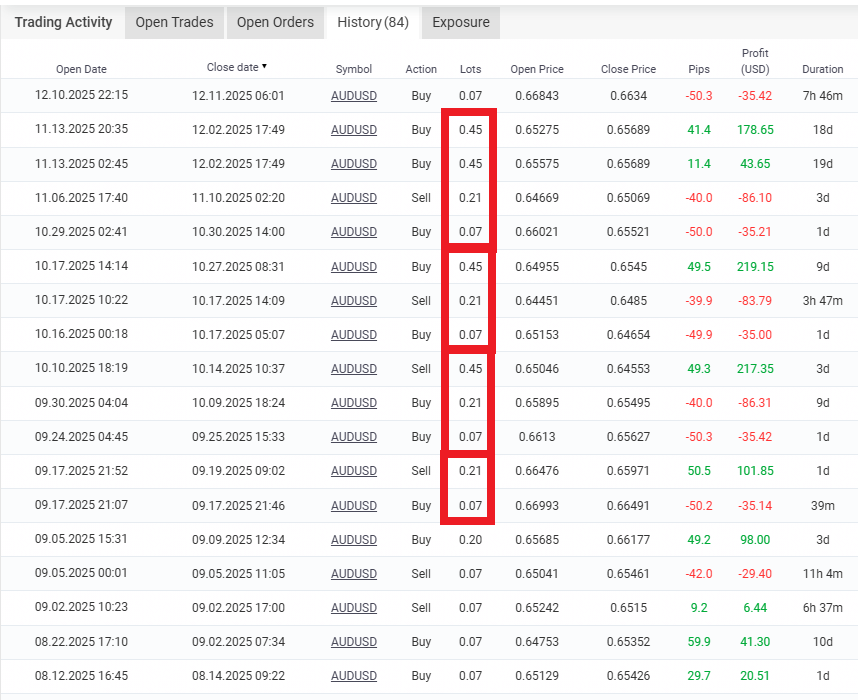

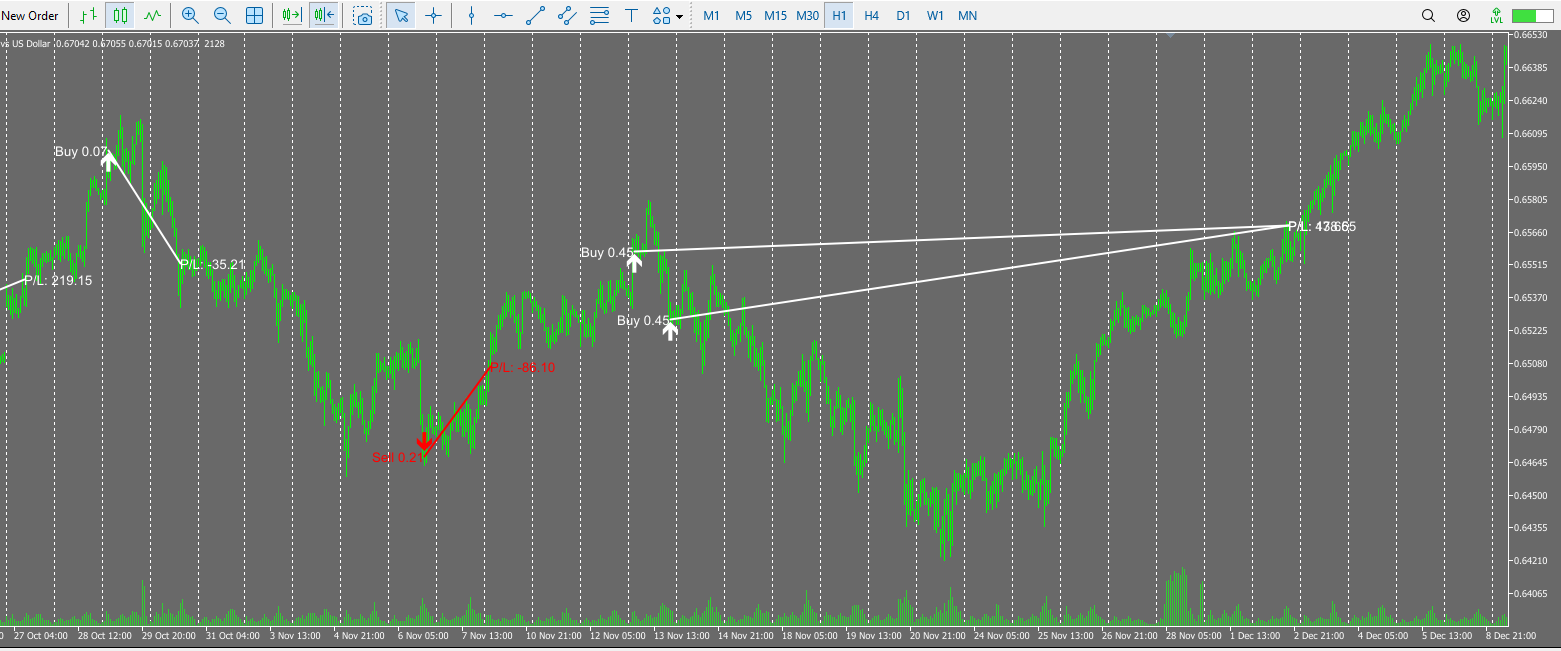

Lot Escalation Pattern Seen in the Trade History

A closer look at the Myfxbook trade history shows that lot sizes are increased step by step after losses. For example, in a sequence of trades in the same direction you can see:

- 1st trade: 0.07 lots

- 2nd trade: 0.21 lots

- 3rd trade: 0.45 lots

This shows a recurring pattern where the lot size is tripled after a loss and then increased to almost double again. It is classic martingale behaviour (increasing the lot size to recover losses). Even if the vendor does not highlight it as such, in practice this has to be evaluated as a high-risk martingale EA.

These increases are not just rare exceptions; the same pattern appears many times throughout the history. This suggests that the strategy itself is designed around systematic lot escalation, rather than the lot increases being occasional manual interventions.

Relationship Between Martingale and Account Balance

Whether a martingale strategy eventually collapses depends heavily on the relationship between account balance and lot size. In the vendor’s account, the balance has already grown significantly, so even with the same lot pattern, the price range the account can withstand before reaching zero is much wider than at the beginning. This can make the current collapse risk look lower than it really is.

On the other hand, copying the same lot pattern on a small account makes it very likely that the balance will be wiped out in a single sequence. In particular, the aggressive escalation from 0.07 → 0.21 → 0.45 lots means that just a few losing trades can easily exceed any reasonable loss limit. For small accounts or traders who do not fully understand risk and money management, this design is extremely dangerous.

Possibility That Only “Survivor” Accounts Are Shown

With grid/martingale EAs, it is common practice to run a large number of forward tests across multiple brokers, symbols, and parameter sets, and then only publish the accounts that happened to survive. MyFxRadar EA may well be one of many similar strategies where only the surviving account has been presented on Myfxbook.

While the current forward results look attractive, once you factor in the underlying strategy and lot escalation, it becomes clear that this is a high-risk martingale EA that could blow up at any time. The forward-test evaluation in this article is based solely on the situation as of 25 December 2025, and the performance could deteriorate sharply depending on future market conditions and lot settings.

Trading Logic and Risk Characteristics

Developer’s Stated Concept

According to the developer, MyFxRadar EA is a trend-following system that detects the start of a trend with a “radar,” filters out noise using indicators such as ADX, and then enters in the direction of the trend. Positions that move into profit are managed with a trailing stop to capture as much of the move as possible.

They also claim that lot sizing is handled by an AutoRisk function and a RiskLimit parameter, while Drawdown Control manages floating losses. These are all features as described by the developer; the actual behaviour must be verified using the forward trading history.

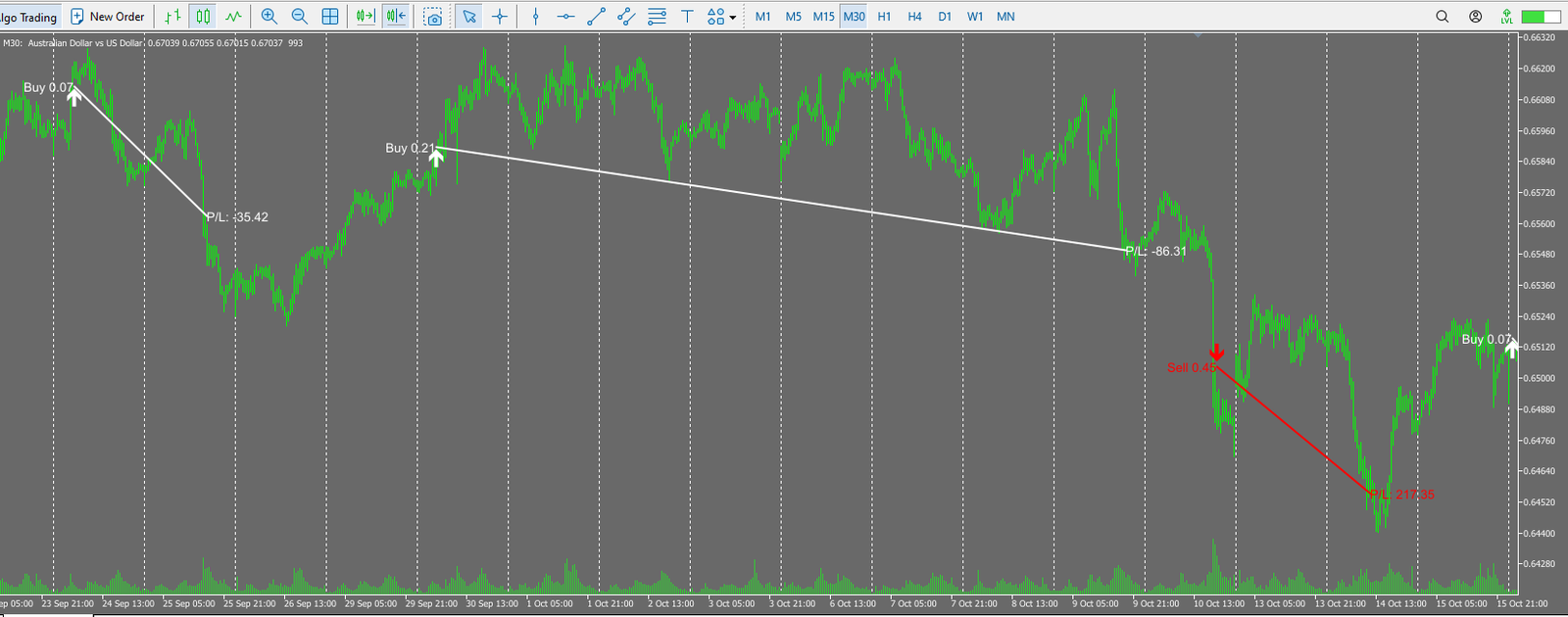

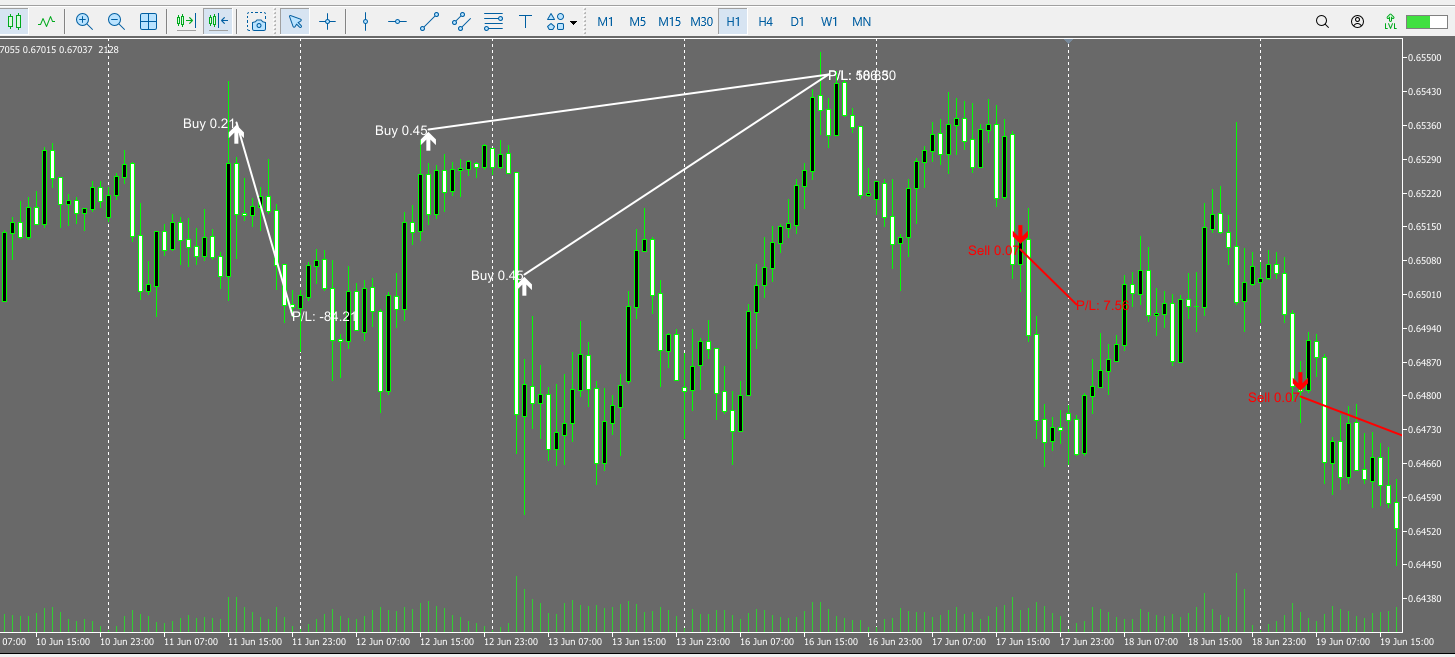

Entries and Lot Increases Seen in the Forward Trades

When the forward trade history is plotted on the chart, white arrows mark buy entries and red arrows mark sell entries. Looking at several sequences, we can observe the following lot progression:

- First trade: a 0.07-lot entry in the direction of the trend

- If this trade closes in loss, a second entry is opened with 0.21 lots, roughly three times the size

- If that also loses, a third position is opened with 0.45 lots, about twice the previous size

In other words, the forward history clearly shows a martingale pattern that steps up the lot size after each loss to recover previous drawdowns.

Combination of Martingale and Grid Averaging

We also see grid-style averaging, where additional positions are opened while existing ones are in floating loss. After entering with 0.21 or 0.45 lots, if price moves against the position and the loss grows, the EA often does not close the trade quickly. Instead, it adds up to two more positions in the same direction and waits for a reversal.

Although the developer describes it as an EA that “rides the trend,” the actual behaviour looks more like:

- Enter in the direction of the trend

- If it loses, re-enter using a tripled lot size (martingale)

- If that also loses, enter again with roughly double that lot size

- While holding floating losses, add up to two grid positions and wait for a reversal

This suggests that the system is in fact using a very aggressive money-management approach that combines martingale with grid averaging.

Risk of Blowing the Account in a Single Move

With this kind of design, the system is very good at quickly recovering losses in the short term, and the forward equity curve naturally tends to slope upward. At the same time, however, the risk of blowing the account in a single strong trend becomes extremely high.

As the lot size escalates from 0.07 → 0.21 → 0.45, only a handful of consecutive losing trades is enough for small accounts with no spare margin to hit the margin-call threshold. The vendor’s published account already has a large balance, giving it much more room before collapse, even with the same lot sizes. But if you copy these settings on a small account, a single powerful trend move can realistically reduce the balance to zero.

Summary: Simple Logic, Extremely High Risk Design

Putting everything together, MyFxRadar EA is better described not as “trend following with a trailing stop,” but as a high-risk strategy that combines martingale with grid averaging. Even if the forward results look good in the short term, the system is constantly exposed to the possibility that a single strong trend move could wipe out the account.

This section is based on the publicly available forward history and the developer’s explanation as of 25 December 2025. Future logic changes or setting adjustments could alter the behaviour, so the analysis should be understood as a snapshot in time.

Overall Evaluation and Summary (as of 25 December 2025)

Overall Assessment of MyFxRadar EA

- Based on the published forward results alone, the AUDUSD account shows profits of over +200%, which looks very strong on the surface.

- However, the actual trade history reveals a classic martingale + grid averaging strategy that aggressively increases the lot size from 0.07 → 0.21 → 0.45, creating an extremely high risk of blowing the account in a single sequence.

- Although the developer describes it as a “trend-following EA,” in reality the core is a money-management scheme built on martingale and averaging, which is not suitable for stable long-term investing.

Who This EA Is (and Is Not) For

- It is intended for highly risk-tolerant traders who are willing to use “spare money they can afford to lose entirely” in exchange for the chance of high short-term returns.

- It is completely unsuitable for wealth building, long-term asset management, or managing retirement and living funds. For traders seeking stability, this EA should be considered inappropriate.

Points to Note If You Still Decide to Run It

- On a small account, copying the vendor’s lot pattern makes it very likely that just a few losing sequences or a strong one-way trend will trigger a margin call.

- If you do invest, limit it to a small portion of your overall capital and treat it as a “lottery ticket” strategy that you are mentally prepared to lose completely.

- You should also keep in mind the possibility that the vendor is running many grid/martingale EAs in parallel and only publishing the few accounts that survived.

Conclusion

MyFxRadar EA delivers attractive forward results in the short term, but it does so by using an extremely high-risk design based on martingale + grid averaging. It is an EA to try only if you fully understand and accept the risk of total loss and restrict it to a small portion of your spare capital. It is not recommended for managing your main trading funds.

In practice this EA behaves as a martingale + grid system that ramps the lot size from 0.07 → 0.21 → 0.45 after each loss. When it gets caught in a one-directional trend, it keeps averaging down while holding large floating losses, so the risk of blowing the account in a single sequence is extremely high.