EA Overview

| Logic Overview | Mean Reversion |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | No |

| Trading Pairs | XAUUSD |

| Developer | Taner Altinsoy |

[Video Guide] Golden Hen EA : Verification & Risk Analysis

This article is also available in a detailed video format. It provides a visual summary of the MT5 live behavior and risk dynamics—insights that are often difficult to grasp from data alone.

[Video Overview]

- Forward Analysis: Real-world trading performance and latest results.

- Backtest Analysis: Evaluating resilience against historical market data.

- Risk Profile: Essential precautions to know before you start trading.

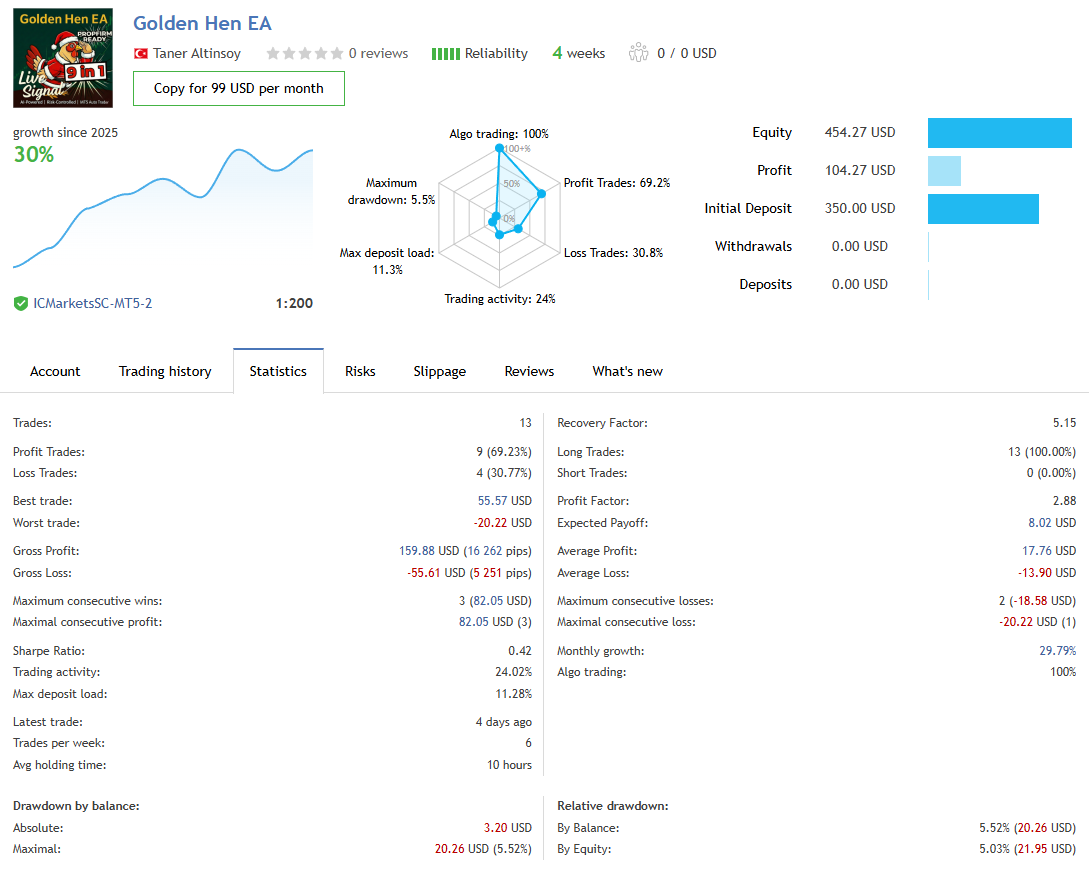

Forward Test (MQL5 Signal) — Current Snapshot (as of 2026/01/12)

About the Public Forward (MQL5 Signal)

Golden Hen EA has a public MQL5 signal (forward performance). Because it can be reviewed via a subscription/copy format, it’s relatively easy to confirm that real trading history is visible to third parties.

That said, a signal is only a “snapshot of today.” When the operating period is short, results may look strong but are difficult to evaluate statistically. In this section, I summarize what is displayed as of the writing date.

Key Metrics (Displayed Today)

- Reliability (age): 4 weeks

- Growth since 2025: ~30%

- Initial deposit: 350.00 USD / Profit: 104.27 USD / Equity: 454.27 USD

- Total trades: 13 (about 6 per week)

- Win rate: 69.2% (9 wins / 4 losses)

- Profit Factor: 2.88

- Average profit: 17.76 USD / Average loss: -13.90 USD

- Max drawdown (by balance): 5.52% (20.26 USD)

- Max drawdown (by equity): 5.03% (21.95 USD)

- Max consecutive wins: 3 / Max consecutive losses: 2

- Average holding time: 10 hours

- Algo trading: 100%

What Looks Good (Win Rate / Risk-Reward)

The win rate is relatively high at ~69%, and a Profit Factor of 2.88 looks strong on the surface. With an average profit (17.76) versus an average loss (-13.90), the average risk-reward does not look extreme.

Drawdown is also around the 5% range so far, which makes the short-term profile look “not overly wild.”

Why It’s Still Too Early to Rate It

In short, this forward test is too short to judge whether the EA truly has an edge.

- Only 4 weeks of operation, so it hasn’t been tested through enough market environments (trend/range/shocks)

- Only 13 trades, so win rate, PF, and DD can be heavily influenced by randomness

- 100% long (0% short), so performance may be biased toward one market direction

- Max drawdown often looks smaller in the early phase; it’s unknown how far it may expand over time

So while the numbers look good, we cannot conclude today that the edge is robust and repeatable.

What to Watch Next (If You Keep Following the Forward)

- At least several months to 6+ months of continued data across changing market regimes

- Whether win rate and PF “converge” as the trade count increases

- How the EA behaves when drawdown expands (loss streaks, any lot-size behavior)

- Whether the long-only bias changes (does it work on shorts, or remain one-sided?)

- Behavior during volatility spikes and spread widening (fills and loss behavior)

Overall, today’s forward looks good in win rate and risk-reward, but the history is still too short to serve as strong evidence.

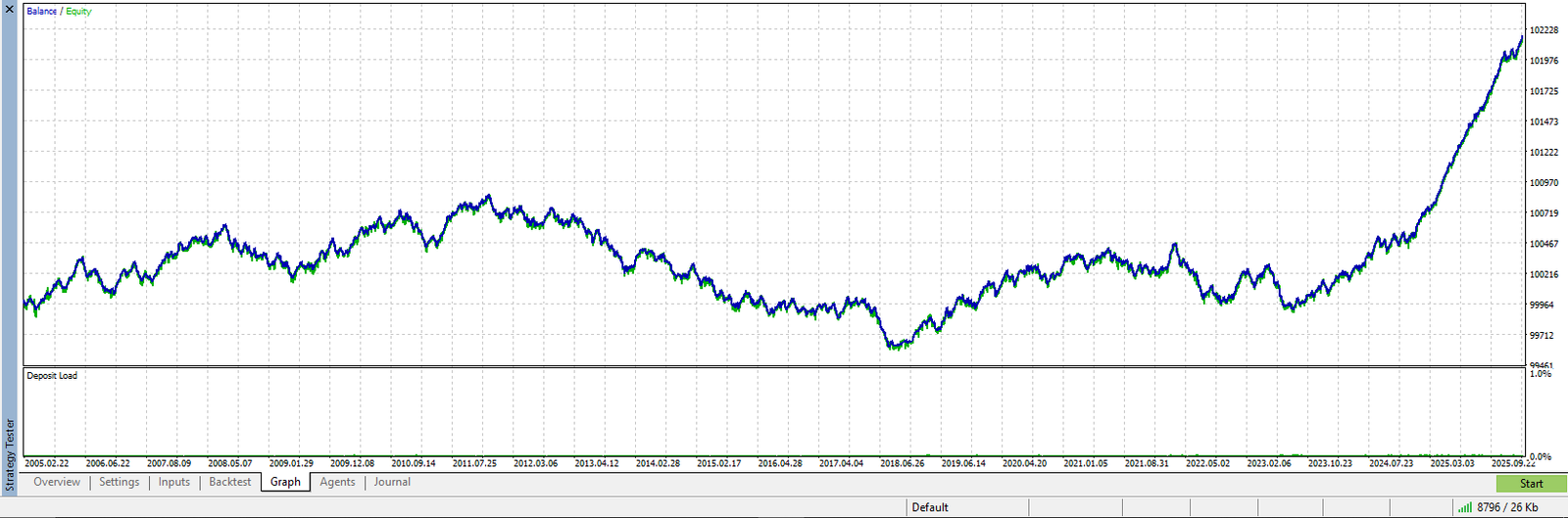

Backtest Analysis (My Test: Long-Term 2005–2026)

To validate the EA, I ran my own backtest on Golden Hen EA. The bottom line: results look much better after 2023, but the earlier period (especially up to 2023) shows clear stagnation, which raises serious concerns about long-term robustness. This section summarizes my findings as of the writing date.

Backtest Settings (My Test Conditions)

- Period: 2005/01/01 to 2026/01/10 (~20 years)

- Symbol: XAUUSD

- Initial balance: 10,000 USD

- Lot size: fixed 0.01 lot

- Other settings: default

- Spread: 60 points

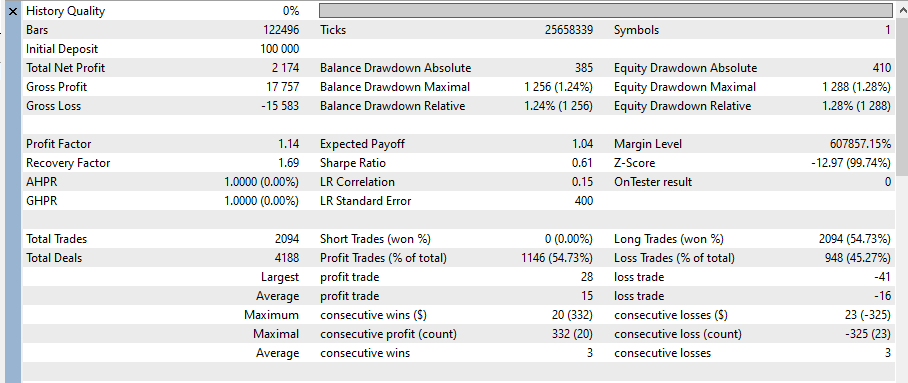

How to Read the Numbers (Why DD % Can Mislead)

MT5 reports drawdown in percentages as well, but balance-based percentages depend heavily on the starting balance and lot size, which can make comparisons unstable. In this review, I evaluate risk using the fixed lot size (0.01) and the absolute equity drawdown in USD.

Key Figures (From the MT5 Report)

- Total trades: 2,094

- Profit Factor: 1.14

- Total Net Profit: +2,174 USD

- Equity drawdown (Absolute): 410 USD

- Max equity drawdown (Maximal): 1,288 USD

- Long-only: 2,094 / Short: 0

Time-Period Bias: Strong Since 2023, Weak Before

Looking at the balance/equity curve, performance improves sharply after 2023 and becomes more strongly upward. In contrast, the long earlier period shows flat-to-weak behavior and noticeable drawdown phases.

This “strong only in recent years” shape is a classic sign that a strategy may fail when the market regime changes, or that it may be over-optimized (overfitted) to the recent environment.

Gap vs Vendor-Presented Backtests (Why Long-Term Robustness Matters)

Vendor-presented backtests often focus on a favorable recent window (for example, around 2025), which can hide weaker periods when you look across decades. When you test ~20 years, the likelihood increases that performance is simply skewed toward a recent regime.

Bottom Line: High Risk of Not Holding Up Long-Term (As of Today)

Under these conditions (XAUUSD, fixed 0.01 lot, 60-point spread, default settings), the EA performs well since 2023, but it is difficult to say the edge is stable over the long run. The maximum equity drawdown reached 1,288 USD, so judging safety based only on a short-term forward is risky.

With that in mind, the next section focuses on the trading logic and risk characteristics.

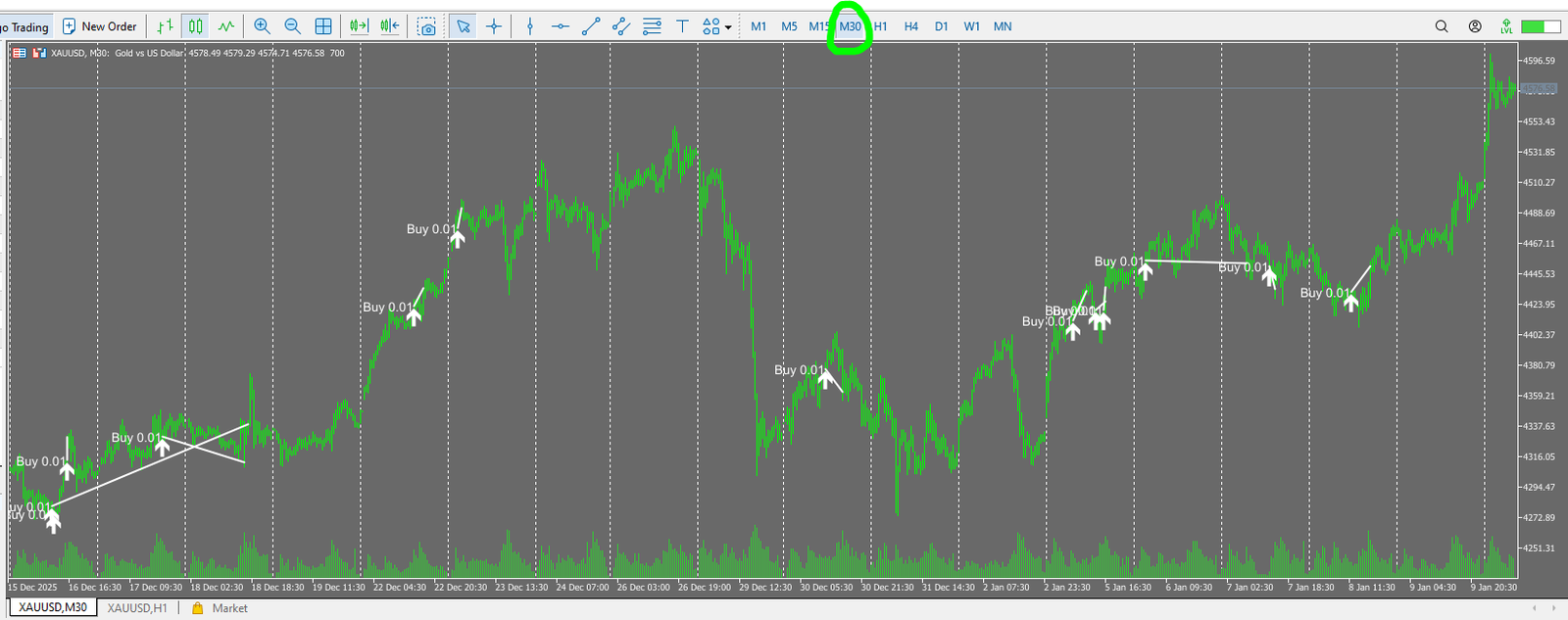

Trading Logic & Risk Characteristics

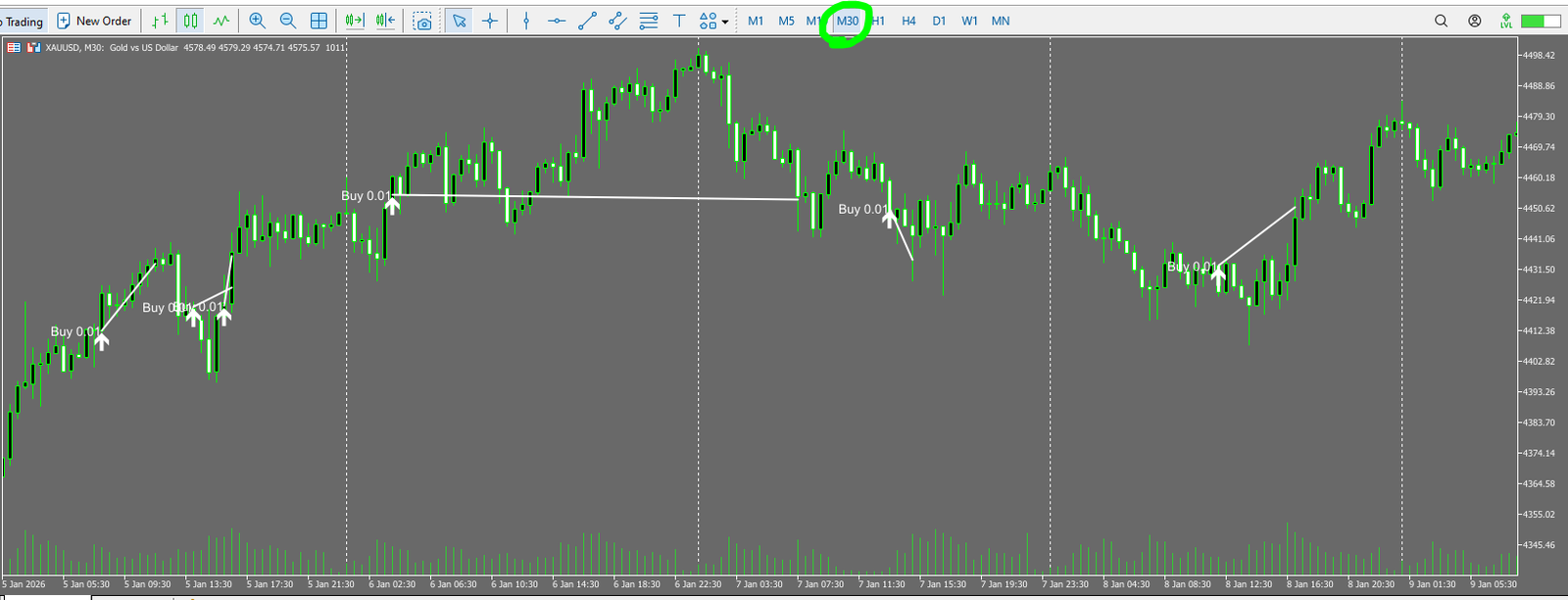

Here I organize the developer’s stated design (official description) and what can be inferred from the MQL5 signal’s forward trade-history charts. The trade-history charts plot the forward trades: white lines are buys and red lines are sells.

What the Developer Claims (Organized Summary)

- Designed for XAUUSD (gold)

- Combines multiple strategies and evaluates entries using multiple timeframes

- Does not use risky methods such as grid/martingale/averaging (developer claim)

- Each trade has predefined SL/TP and uses proper stop-loss behavior (developer claim)

- Not a scalping EA that snatches a few pips; it aims for broader price moves and can hold trades longer

What the Forward Trade History Suggests

- Buy-only trading (no visible sell trades in the current forward history)

- Entries are not overly dense, so it doesn’t look like a rapid-fire scalper

- Holding time tends to be longer, closer to “riding the move” than quick in-and-out trades

A buy-only bias can be either a strength or a weakness depending on the environment. It can benefit from persistent uptrends, but may struggle when gold stays in a prolonged downtrend, with fewer opportunities or weaker performance.

Risk View: Good on Paper, But Long-Term Validity Is Unclear

The developer claims the EA avoids grid and martingale and manages trades with SL/TP. Compared to “loss-avoidance” systems that postpone losses and eventually blow up, this is a healthier baseline.

However, my long-term backtest (~20 years) shows performance skewed toward the recent market (since 2023) and weaker behavior before that. As a result, it’s still unclear whether the EA will hold up long-term, and the edge may weaken if the market regime changes.

Conclusion So Far (Logic & Risk Characteristics)

- Aims to avoid risky methods like grid/martingale (developer claim)

- Not a scalper; tends to target wider moves

- Trades buy-only, with no sells observed so far

- Uses stop-loss management via SL/TP (developer claim)

- But long-term robustness remains uncertain based on the backtest results

Overall Verdict & Summary

Golden Hen EA has a public MQL5 signal, and the current forward looks strong in terms of win rate and Profit Factor. However, the track record is short and the trade count is small, so it’s not enough to claim a proven edge. In my long-term backtest, performance is heavily skewed toward the recent period (since 2023), so long-term viability is still unclear.

Pros (What Looks Positive So Far)

- A public MQL5 signal is available, so forward history is visible to third parties

- The short-term forward shows a relatively high win rate and acceptable risk-reward

- The developer claims it avoids dangerous methods like grid/martingale

- Not a scalper; trades are managed with SL/TP and include stop-loss behavior

Cons / Concerns (Why the Rating Stays Cautious)

- The forward history is short (only a few weeks) and the trade count is too small for statistics

- Forward behavior appears buy-only, which can be regime-sensitive

- In the long-term backtest, performance improves after 2023 but is weak before that

- Vendor backtests may focus on favorable windows (e.g., 2025), making long-term robustness harder to confirm

- There is a strong risk of over-optimization to the recent market environment

Verdict (As of This Article)

- The baseline design (no grid/martingale, stop-loss behavior) is not bad

- But judging based on short-term forward performance alone is risky

- Long-term reproducibility is unclear, so this remains a “wait-and-see” EA for now

What Would Be Needed to Upgrade the Rating

- At least several months to 6+ months of forward history through changing market regimes

- Confirmation that win rate, PF, and DD remain stable as the trade count increases

- Clear evidence of how the buy-only behavior performs during extended drawdowns or downtrends

Overall, Golden Hen EA is “good-looking in the short term, but difficult to judge for the long term as of today.” If you’re considering buying or running it, don’t rely on the short forward stats alone—prioritize long-term robustness and validate it in your own environment first.

According to the developer, the EA does not use grid or martingale, and every trade is managed with predefined SL/TP (so it does cut losses). However, in my ~20-year backtest, the maximum equity drawdown reached 1,288 USD, so long-term stability is still unclear.