EA Overview

| Logic Overview | Mean Reversion |

|---|---|

| Martingale | Yes |

| Grid | Yes |

| Scalping | No |

| Developer | FOREX STORE |

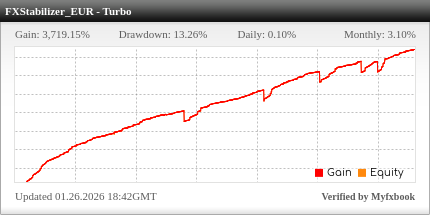

Forward Test Analysis (FXStabilizer_EUR – Turbo)

Forward Account Settings (Conditions as Observed Today)

This section is based on the publicly available forward information (screen capture) as of December 22, 2025. The account is labeled “Real (USD Cent),” the broker is Markets4you, leverage is 1:500, and the platform is MT4. Because this is a cent account, balances and profit/loss figures are displayed differently from a standard account, so you should be careful not to underestimate the risk based on the nominal numbers alone.

Duration and Shape of the Equity Curve

The forward track record runs roughly from April 2016 to the end of 2025, so the operating period is long, which is a positive point. The growth curve is upward-sloping and looks very attractive at first glance. However, there are several “steps” and “dips” where the balance drops, so it is far from a perfectly smooth line.

Key Metrics (Values Displayed as of Today)

On the screen, the gain is around +3,715%, the monthly return is about 3.13%, and the drawdown is shown at about 13.26%, which appears relatively low. This combination looks excellent, but as we will see from the trading history, the behavior is typical of a grid–martingale system, so it is safer to assume this is a strategy that appears stable in normal times but can change dramatically under stress.

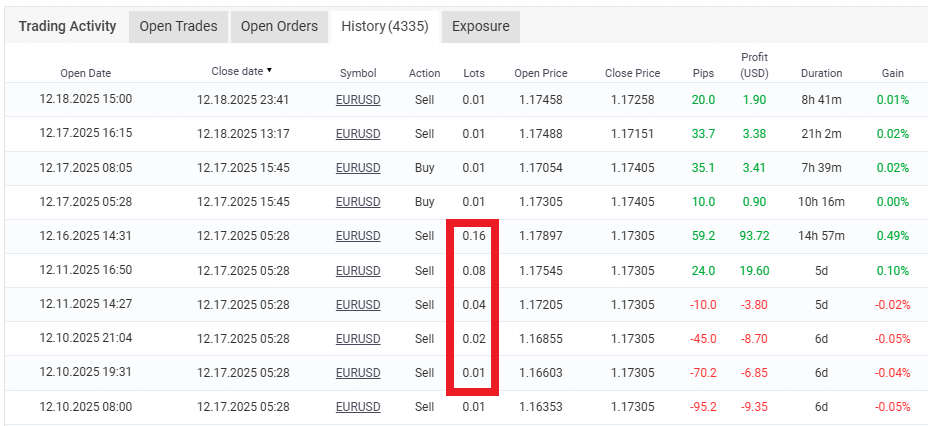

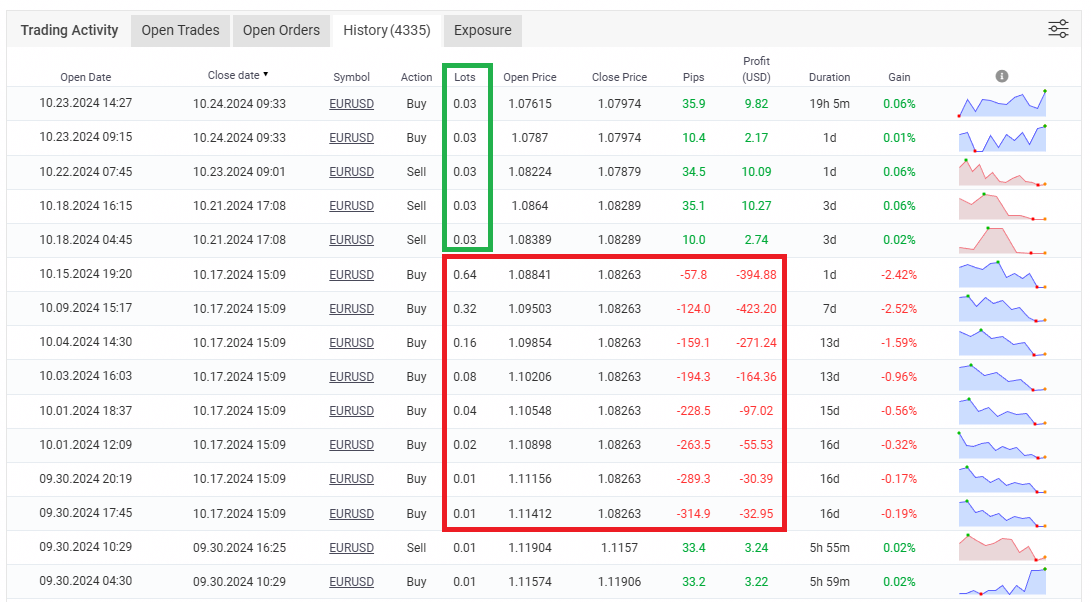

Patterns Seen in the Trade History (Typical Grid/Martingale)

In the history you can see sequences where the lot size increases from 0.01 → 0.02 → 0.04 → 0.08 → 0.16 in a classic doubling pattern. This is the typical behavior of a grid + martingale system: adding positions as the unrealized loss grows in order to move the average entry price closer to the current price and then aiming to close all positions for a profit on a rebound.

You can also see many cases where multiple positions are closed at the same time (or within a very short time window), which suggests that the system is designed to close the entire basket together rather than taking partial profits or individual stop losses. This type of strategy tends to grow steadily most of the time, but when a trend continues for a long period the lots balloon and losses can accelerate quickly.

Drawdown Phases: Forced Liquidation and the Story Behind the “Fast Recovery”

There are several points where the balance drops sharply, and the history shows consecutive trades with large negative pips and large monetary losses. With this kind of grid–martingale strategy, a persistent trend can become unbearable and eventually lead to a margin call or forced liquidation.

At the same time, the balance seems to recover quickly afterwards. However, when you look closely at the history, there are phases where the “initial lot size (base lot)” after a drawdown appears to be higher than before. If the base lot is increased after a loss to speed up recovery, this is effectively raising the risk to win back losses, which is a very dangerous practice that further increases the probability of blowing the account.

Such increases in the base lot may occur purely through the EA’s logic, but they may also reflect discretionary adjustments by the vendor (manual intervention). In any case, it is unrealistic to expect that a customer will get the same “beautiful equity curve” simply by running the EA unattended with the same settings.

Balance Size and Probability of Ruin: The Smaller the Equity, the Worse the Odds

When a grid–martingale strategy will blow up depends not only on market conditions but also heavily on the combination of account balance (staying power) and lot size. The vendor’s account has already grown, so even with the same lot settings it has more buffer and therefore a lower probability of ruin. In contrast, if you apply similar risk settings on a small account, the probability of the balance being driven close to zero is much higher.

Forward Results May Also Reflect Survivor Bias

If you run many trials (many accounts and many settings) with grid–martingale systems, a few accounts will simply survive without major crashes by chance. Therefore, we must always consider the possibility that the showcased forward account is just “one of the few survivors” out of many tests. The long forward period is a positive point, but we have no way of knowing how many failed accounts are hidden from view.

Conclusion as of Today: Attractive but Reproducibility and Worst-Case Risk Come First

As of today, the long forward history, upward equity curve, and relatively low DD make the performance look attractive. However, the trading history clearly shows typical grid–martingale behavior, such as lot doubling and batch closing, so it is reasonable to assume a high risk of large losses during stress periods. If you consider using this EA, at a minimum you should (1) avoid overconfidence with a small account, (2) refrain from increasing the base lot aggressively to chase recovery, and (3) verify in advance whether the system can survive worst-case scenarios such as prolonged trends.

Forward Test Analysis (FXStabilizer_EUR – Turbo)

Forward Account Settings (Conditions as Observed Today)

This section summarizes the publicly available forward information (screen capture) as of December 22, 2025. The account is labeled “Real (USD Cent),” the broker is Markets4you, leverage is 1:500, and the platform is MT4. Because this is a cent account, balances and profit/loss figures are displayed differently from a standard account, so you should be careful not to underestimate the risk based on the nominal numbers alone.

Duration and Shape of the Equity Curve

The forward track record runs roughly from April 2016 to the end of 2025, so the operating period is long, which is a positive point. The growth curve is upward-sloping and looks very attractive. However, there are several “steps” and “dips” where the balance drops, so it is not a completely straight line.

Key Metrics (Values Displayed as of Today)

On the screen, the gain is around +3,715%, the monthly return is about 3.13%, and the drawdown is about 13.26%, which appears relatively low. This combination looks excellent, but as we will see from the trading history, the behavior is typical of a grid–martingale system, so it is safer to assume this is a strategy that appears stable in normal times but can change dramatically under stress.

Patterns Seen in the Trade History (Typical Grid/Martingale)

In the history you can see sequences where the lot size increases from 0.01 → 0.02 → 0.04 → 0.08 → 0.16 in a classic doubling pattern. This is the typical behavior of a grid + martingale system: adding positions as the unrealized loss grows in order to move the average entry price closer to the current price and then aiming to close all positions for a profit on a rebound.

You can also see many cases where multiple positions are closed at the same time (or within a very short time window), which suggests that the system is designed to close the entire basket together rather than taking partial profits or individual stop losses. This type of strategy tends to grow steadily most of the time, but when a trend continues for a long period the lots balloon and losses can accelerate quickly.

Drawdown Phases: Forced Liquidation and the Story Behind the “Fast Recovery”

There are several points where the balance drops sharply, and the history shows consecutive trades with large negative pips and large monetary losses. With this kind of grid–martingale strategy, a persistent trend can become unbearable and eventually lead to a margin call or forced liquidation.

At the same time, the balance seems to recover quickly afterwards. However, when you look closely at the history, there are phases where the “initial lot size (base lot)” after a drawdown appears to be higher than before. If the base lot is increased after a loss to speed up recovery, this is effectively raising the risk to win back losses, which is a very dangerous practice that further increases the probability of blowing the account.

Such increases in the base lot may occur purely through the EA’s logic, but they may also reflect discretionary adjustments by the vendor (manual intervention). In any case, it is unrealistic to expect that a customer will get the same “beautiful equity curve” simply by running the EA unattended with the same settings.

Balance Size and Probability of Ruin: The Smaller the Equity, the Worse the Odds

When a grid–martingale strategy will blow up depends not only on market conditions but also heavily on the combination of account balance (staying power) and lot size. The vendor’s account has already grown, so even with the same lot settings it has more buffer and therefore a lower probability of ruin. In contrast, if you apply similar risk settings on a small account, the probability of the balance being driven close to zero is much higher.

Forward Results May Also Reflect Survivor Bias

If you run many trials (many accounts and many settings) with grid–martingale systems, a few accounts will simply survive without major crashes by chance. Therefore, we must always consider the possibility that the showcased forward account is just “one of the few survivors” out of many tests. The long forward period is a positive point, but we have no way of knowing how many failed accounts are hidden from view.

Conclusion as of Today: Attractive but Reproducibility and Worst-Case Risk Come First

As of today, the long forward history, upward equity curve, and relatively low DD make the performance look attractive. However, the trading history clearly shows typical grid–martingale behavior, such as lot doubling and batch closing, so it is reasonable to assume a high risk of large losses during stress periods. If you consider using this EA, at a minimum you should (1) avoid overconfidence with a small account, (2) refrain from increasing the base lot aggressively to chase recovery, and (3) verify in advance whether the system can survive worst-case scenarios such as prolonged trends.

Backtest Analysis (Vendor-Published Report)

Premise: A Backtest Designed to Look Good

This section is based on the vendor’s published backtest results (screenshot) available as of December 22, 2025. In the report parameters we can see AutoRisk=true, which means this is a variable-lot backtest where lot size is automatically adjusted according to the account. Since users cannot easily replicate the exact same broker, history data, and spreads, these results are simply “performance generated under conditions chosen by the vendor in the vendor’s own environment.”

Test Conditions and Period: Seven Years Is Not Really “Long Term”

The test is run on EURUSD H1 using the “Every tick” model with 90% modeling quality. At first glance it looks like a serious backtest, but the period is only about seven years, from 2009 to late 2016, which is far from sufficient to fully evaluate a grid–martingale EA. These strategies can blow an account with just one major trend, so even if the system survives seven years, there is always the possibility that it simply avoided the worst conditions by chance.

How to Read the Profit, PF, and Drawdown

With an initial deposit of 10,000, the total net profit is large and the profit factor (PF) of 2.10 looks good. The maximum drawdown of about 33% is also not catastrophic as a number on its own. However, all of these metrics are based on a variable-lot system with AutoRisk=true. By changing lot size you can dramatically change PF and DD even with the same core logic. Because we do not know how much risk was embedded to achieve these figures, it is dangerous to call the system “excellent” based on the numbers alone.

Why Individual Trade Statistics Mean Little for a Grid/Martingale EA

The report shows over 1,800 trades with a win rate of about 60%, but for a grid–martingale EA, individual trade statistics are not very meaningful. These systems build positions step by step and wait for the entire basket of positions to become profitable, so metrics like average profit per trade or the number of consecutive wins/losses do not accurately reflect the true risk. What really matters is how much unrealized loss the system is willing to tolerate and at what point it is forced to close the basket, but the published backtest does not clearly show these danger levels.

Problem with Variable Lot: Poor Reproducibility for Users

Because AutoRisk automatically adjusts lot size, the effective risk level of “the same settings” will differ greatly between the vendor’s backtest and a user’s live account. Differences in broker, account type, balance, spreads, swaps, and execution quality will change the timing of lot increases and margin calls, which in turn will change DD and final profit. On top of that, it is entirely possible that the vendor simply chose not to publish “bad backtests” and instead showcased only the better-looking runs.

Critical Summary: A Document That Showcases the Upside of Grid/Martingale

The published backtest is clearly crafted to look attractive, with an upward curve, high PF, and a seemingly acceptable 33% DD. In reality, it is just one example of a grid–martingale system with variable lot sizing, and it reveals very little about the full risk or probability of ruin. The seven-year test period is not long, and it does not rule out the possibility that the system simply did not encounter a truly severe market regime.

Therefore, treating this backtest as “proof of long-term stability” is dangerous. A more appropriate stance is to ask: if a strong trend like those seen in the past happens again, will the account really survive? Each trader must verify this for themselves based on their own capital, risk tolerance, and fixed-lot settings.

Trading Logic and Risk Characteristics

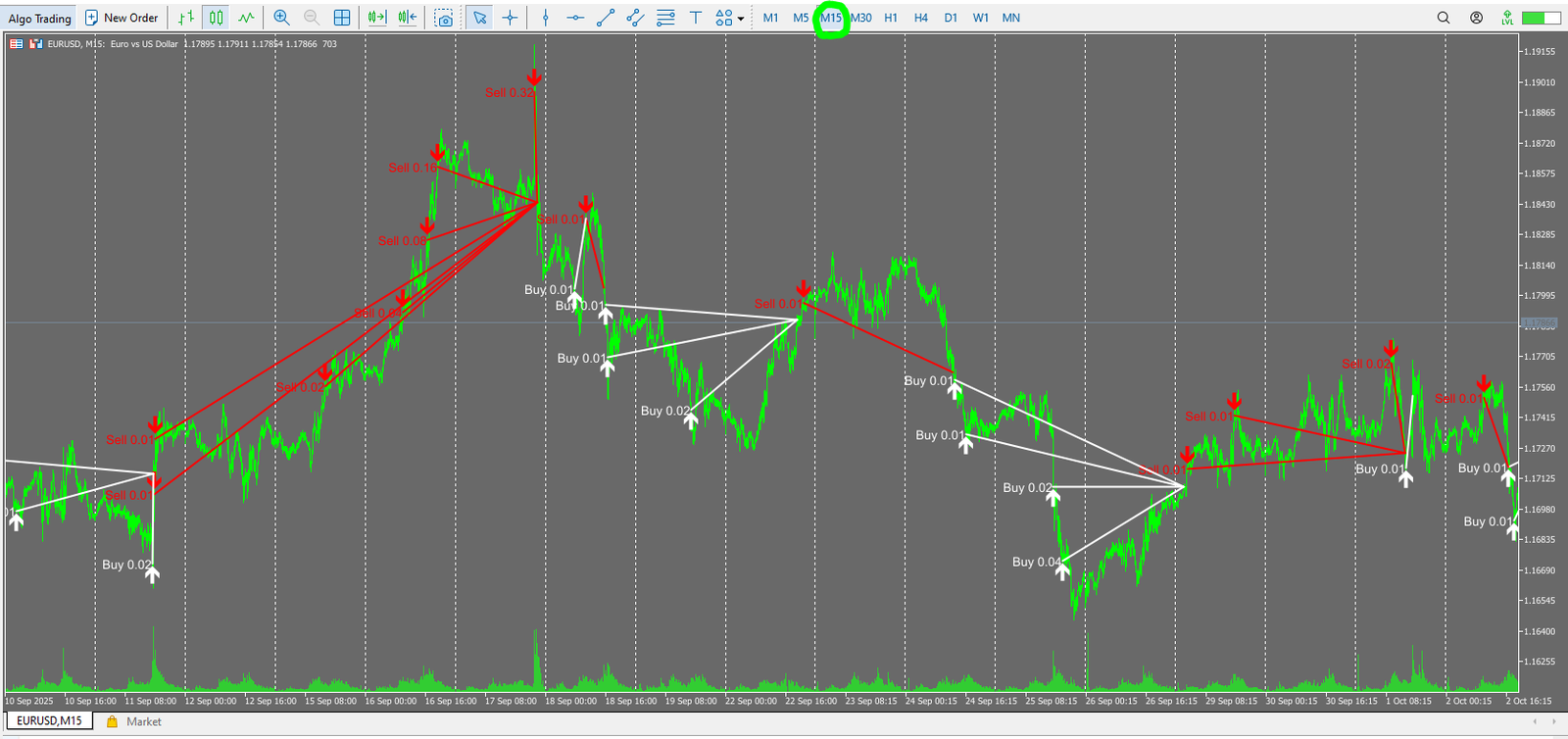

Basic Structure: A Very Simple Grid + Martingale EA

Looking at the actual trade history of FXStabilizer, plotted on the chart from the forward results, it becomes clear that the logic is a very simple grid + martingale strategy. On the chart, white arrows mark buy positions and red arrows mark sell positions, and you can clearly see positions being added step by step in the same direction.

Entries are basically counter-trend. After a strong move in one direction, the EA opens an initial position when it judges that a reversal may be near, and then places additional orders at roughly 30-pip intervals. Because the grid spacing (distance between positions) is almost constant, this appears to be a purely mechanical process, not a discretionary one.

How Lot Size Increases: Same Lot for the First Add, Then Doubling

The lot history shows that the initial entry and the first additional entry use the same lot size (for example, 0.01 → 0.01), but from the second add onward the lot size is doubled compared to the previous one (0.01 → 0.02 → 0.04 → 0.08 → 0.16 …). This is a textbook martingale approach, where larger lots are added as the unrealized loss grows in order to pull the average entry price closer to the current market price.

As a result, even a small reversal can quickly push the entire basket of positions into profit. FXStabilizer is built around this “waiting for the rebound” idea: as long as the market eventually returns, it closes the basket and books a profit, repeating this cycle over and over.

Exit Logic: Holding On Until the Basket Turns Positive

When you follow the exit timing on the chart, you can see that profits and losses are not managed trade by trade. Instead, there are many instances where multiple positions are closed at once. Even if individual positions are in the red, the EA closes all of them together when the total P&L reaches a certain profit level—a typical approach for grid and martingale EAs.

In range or choppy markets, this often leads to “almost every basket ending with a profit,” but the balance between wins and losses is extremely uneven. Winning baskets accumulate small gains, whereas losing baskets are forced liquidations of the entire position group, giving back a large chunk of accumulated profit in a single event.

Gap Between the Developer’s Marketing and Reality

On the official site, the developer promotes features such as “long-term stable operation,” “drawdown control,” and mode switching between Durable and Turbo for stability versus growth. They also mention a Boost mode that temporarily raises risk and claim to have certain risk limits in place.

However, as we saw, the actual trading pattern is nothing more than a simple counter-trend grid + martingale. Even if “risk control” is mentioned, crucial details such as “how far the grid can extend” and “at what level the basket is cut” are hidden from the user. Even if the reported drawdowns look small, there is always the possibility that we are only seeing periods before any catastrophic margin calls occurred.

Risk Profile: Danger of a One-Shot Account Blow-Up in Strong Trends

The biggest risk with this EA is that a sustained, clear trend can produce a single massive loss. Because it enters counter-trend, adds every 30 pips, and doubles lot size, unrealized losses grow exponentially if the market keeps moving in one direction without a significant pullback.

If the account balance is not large enough, the margin level will deteriorate rapidly, and there is a high chance of a margin call that wipes out the entire basket. The loss in such a scenario can easily exceed what most traders imagine as a “normal losing trade.”

In summary, FXStabilizer’s trading logic is “a typical grid & martingale EA that grinds out profits most of the time but can blow up spectacularly when the market moves against it”. The logic itself is simple and easy to understand, but it must be recognized as a high-risk strategy where poor money management or underestimating worst-case scenarios can result in the account being wiped out in a single event.

Overall Evaluation and Summary

The Bright and Dark Sides of FXStabilizer

- The public forward results show several years of upward equity with relatively modest drawdowns, so at first glance it looks like a very attractive EA.

- In reality, however, the trading pattern is a simple, classic high-risk strategy: counter-trend grid plus martingale.

- There are points in the forward account where the base lot seems to increase after a margin call to speed up recovery, which strongly suggests manual intervention by the vendor and makes it unlikely that users can reproduce the same curve without such tinkering.

Reliability of the Backtests and Forward Results

- The vendor’s backtests are just about seven years of results with variable lot sizing (AutoRisk) and cannot be considered proof of long-term stability.

- PF 2.10 and max DD 33% look fine as numbers, but they are based on lot adjustments, and there is no guarantee that the same risk/return profile can be reproduced in a user’s environment.

- The forward account may simply be one of many tests where this particular system happened to survive, so we must always consider that possibility.

Risk Profile and Suitable User Type

- This EA can steadily accumulate profits in ranges or choppy markets, but it has a structure where a single strong trend can blow the account.

- Whether it survives or fails depends heavily on the combination of “account balance and lot size,” so an account that has already grown like the vendor’s and a small retail account face very different probabilities of ruin.

- It might be an option if you are using “pure risk capital that you can afford to lose entirely,” but it is clearly unsuitable for funds you cannot afford to lose or for conservative wealth management.

Conclusion as of Today (December 22, 2025)

- FXStabilizer is an EA whose headline performance looks flashy, but the underlying logic is a simple grid & martingale, so it cannot reasonably be expected to be safe over the long term.

- If you are considering purchasing it, you must assume from the outset that “a major trend could someday blow the account,” and strict self-defense measures such as using small capital, low lots, and taking profits out regularly are the bare minimum.

- Rather than an EA for stable asset growth, it should be positioned as one for traders who fully understand and accept the risks of grid–martingale systems and still want to experiment with them.

This is a classic martingale EA that builds a counter-trend grid and doubles the lot size from the second additional position onward. Under normal conditions it stacks up small profits, but if it gets caught in a one-way trend there is a real risk of losing most of the account in a single hit. It is not suitable for stable long-term investing and should only be considered as a high-risk EA for money you can afford to lose entirely.