EA Overview

| Logic Overview | Mean Reversion |

|---|---|

| Martingale | Yes |

| Grid | Yes |

| Scalping | No |

| Developer | FOREX STORE |

Forward Test Analysis (All Accounts Currently Stopped)

All Forward Accounts Have Stopped as of Today

Based on the Myfxbook information available as of today (26 December 2025), all official ForexTruck forward accounts have stopped running.

The AUDUSD account suffered a major loss in December 2024 and effectively blew up, and around the same time the EURGBP account also stopped opening new trades.

Since then, no new positions have been added on any account, and the forward tests are effectively “frozen,” leaving only their past performance visible.

EURGBP Forward Account: Smooth Growth, but Around 82% Max Drawdown

The EURGBP forward account (Real, FXOpen, initial deposit $1,000) recorded a gain of around +590% over roughly two years from November 2022 to the end of 2024, with the balance rising to over $6,000 at its peak.

Looking only at the chart, the equity curve is a clean, almost straight uptrend with minor pullbacks.

However, the detailed statistics show a maximum drawdown of about 82%, which is extremely large, meaning that at some point the account nearly lost most of its balance.

Behind the smooth curve, there were multiple periods of severe unrealized loss, so it is more accurate to see this as an account that “barely survived.”

This EURGBP account also stopped trading after its last trades in December 2024, and its performance has not been updated at all since then.

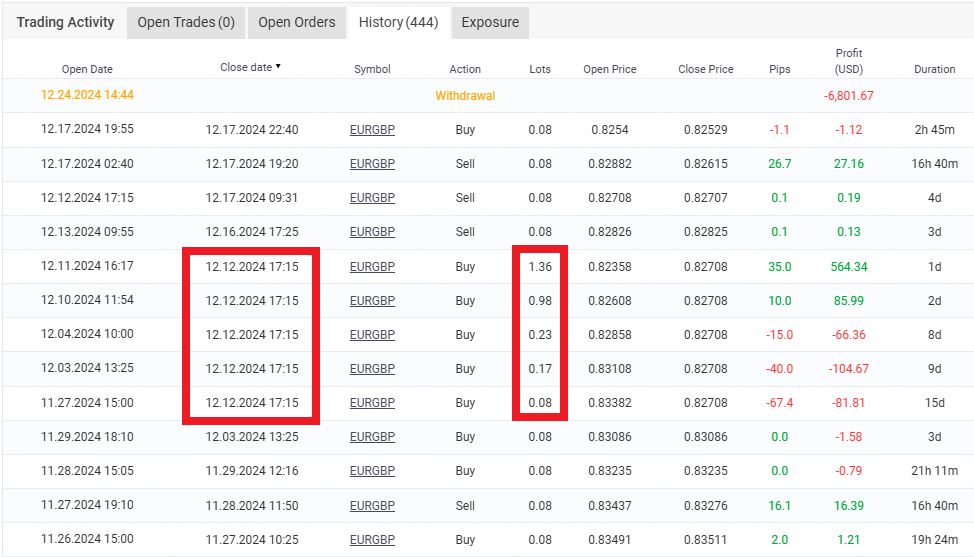

A Grid + Martingale Strategy Revealed by the Trade History

When you track the forward trade history by pips and profit/loss movements, it becomes clear that ForexTruck is a grid (averaging down) + martingale strategy.

It repeatedly adds positions in the same direction against an existing losing trade, stacking multiple orders step by step as price moves further against it.

In the EURGBP trade sequence in December 2024 in particular,

the lot size increases step by step from 0.08 → 0.17 → 0.23 → 0.98 → 1.36 lots, which is classic martingale behavior—scaling up as losses expand.

Even if the pip movement itself is not huge, increasing lot size makes the dollar P/L swing much larger.

This is a textbook trait of martingale EAs: “the curve looks great while it is winning, but collapses the moment it starts losing.”

Blow-Up Risk Depends Heavily on Balance and Lot Size

Because the vendor’s accounts had already grown their balance through long-term operation, the short-term probability of blowing up is somewhat lower as long as the same lot settings are used.

Whether a martingale strategy survives depends heavily on both “how much balance is available to absorb deep unrealized losses” and “how aggressively lot sizes are increased.”

On the other hand, if you run the same logic on a small account (for example a few hundred to around $1,000), there is almost no room to withstand drawdown.

You should assume the probability of the account going to zero in a strong one-way trend is extremely high.

“The vendor’s account survived so far” and “my small live account will also survive” are completely different questions.

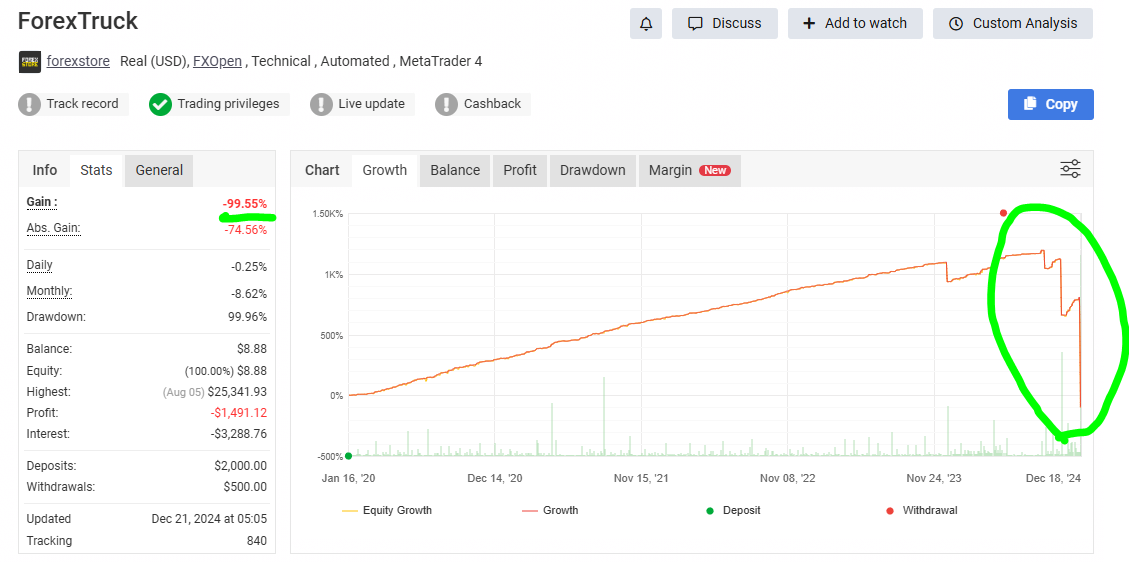

AUDUSD Account Collapse: A Typical Ending for a Martingale EA

In another ForexTruck account published by the same vendor (running AUDUSD), the balance increased from $2,000 to a maximum of $25,341, but a single major drawdown drove it down to $8, effectively blowing up the account.

For a time, the gain exceeded +1,000% and performance looked excellent, but the final losing streak wiped out not only most profits but also almost all initial capital.

The equity curve of this account also looked very smooth right up until the blow-up, showing that “a beautiful curve does not equal safety.”

And since trading stopped across all forward accounts (including EURGBP) after the AUDUSD collapse, it is reasonable to assume this drawdown was a major turning point for the vendor.

How to Read the Vendor’s Forward Results

With grid + martingale EAs, developers often run many accounts and many parameter sets in parallel, and only publish the accounts that happened to survive for a long time on Myfxbook.

If you run enough forward tests, it is statistically natural that a few “lucky accounts that have not blown up yet” remain.

Given the AUDUSD collapse and the halt of all accounts, it is hard to dismiss the possibility that ForexTruck is being presented in the same way.

Therefore, you should not take the beautiful EURGBP equity curve at face value.

Instead, you should view it with the assumption that “a high-risk grid + martingale strategy just happened to survive up to now.”

Including the fact that all forward tests are already stopped, the most realistic positioning is that this is not an EA for long-term stable operation, but rather one that should only be tried with a small amount of money—fully prepared for a total loss.

Trading Logic and Risk Characteristics

The Developer’s Stated Concept

According to the developer, ForexTruck uses a “special logic where two blocks cooperate.”

The description suggests that Block 1 executes the main trades, while Block 2 covers losing positions to control overall risk.

They also highlight versatility and safety with claims like “automatically adjusts risk to account balance” and “handles various market conditions.”

However, after closely reviewing the real forward history and charts, we can see that—contrary to the marketing image—it is a high-risk strategy combining martingale and grid (averaging down).

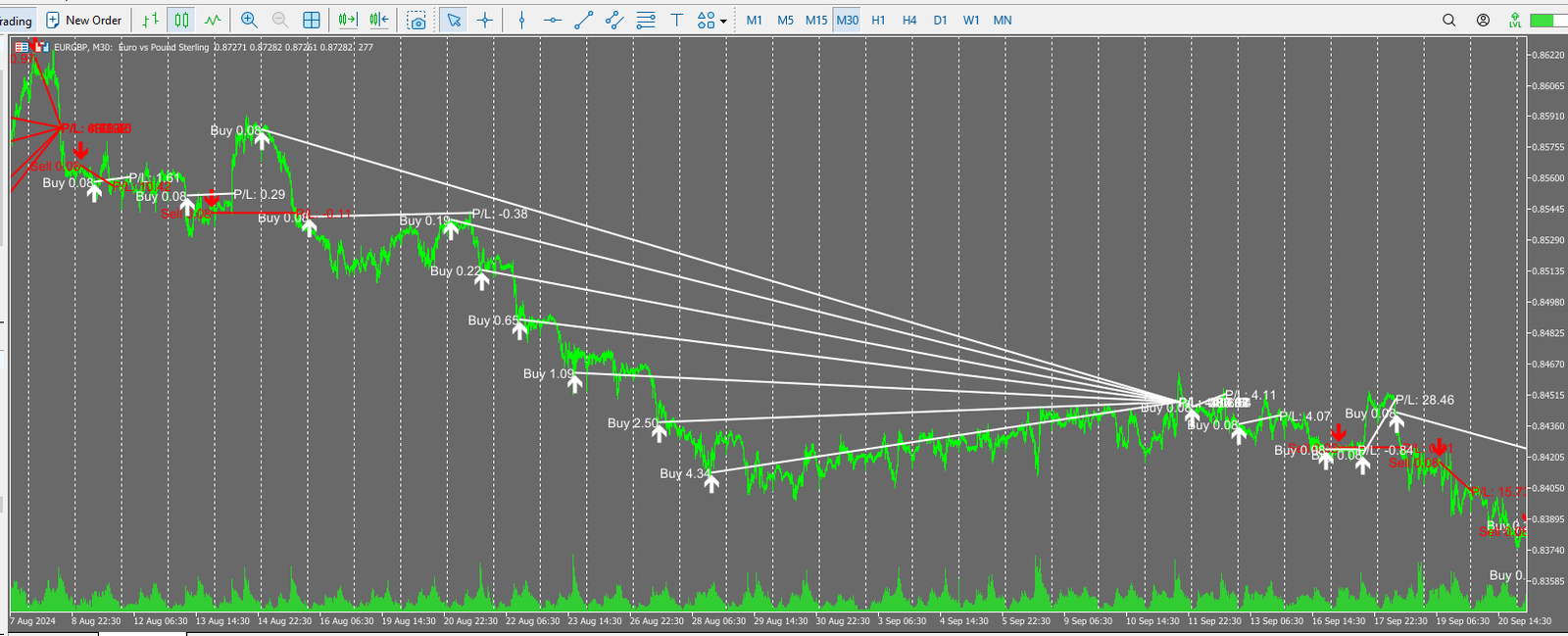

What the Forward Trade Plot Actually Shows

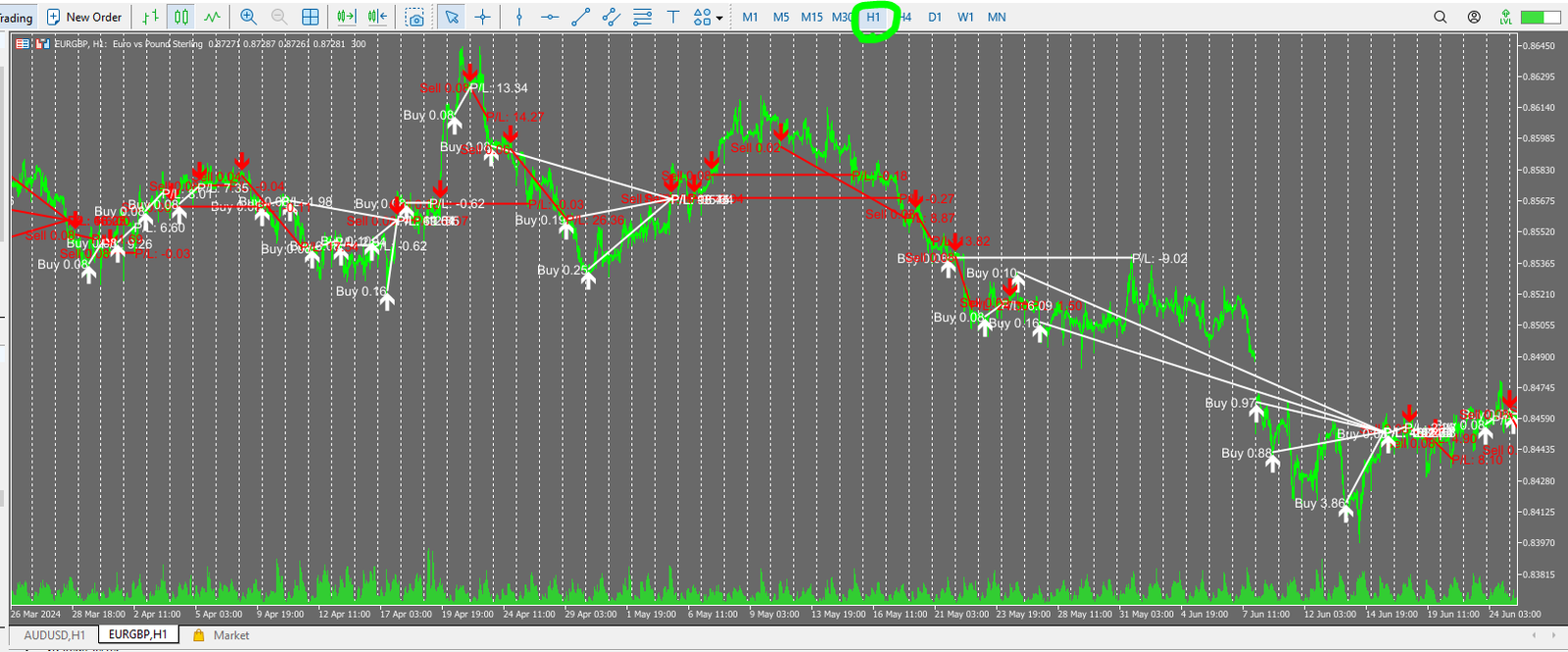

The chart below is the vendor’s forward history plotted on MT5.

White arrows and lines represent buy positions, while red arrows and lines represent sell positions.

You can clearly see repeated patterns of adding positions against the trend and then closing them together when price retraces.

Looking at the H1 chart below, you can see sells added during upswings and buys added during downswings.

At first glance it may look like hedging or two-way trading, but in reality it is stacking positions into the losing direction as price moves against the trade.

Martingale as the Core: Risk of a One-Shot Wipe-Out

As already shown in the forward analysis, ForexTruck’s core is martingale.

When unrealized losses grow, it increases lot sizes step by step to pull the average entry price closer and aims to exit the basket in profit.

In the short term, this often produces a smooth upward curve, but when a strong one-way trend persists, the risk of wiping out the account in a single move becomes extremely high.

In fact, one official forward account (AUDUSD) built large profits over time, then plunged to near-zero in the final drawdown, and the forward test was stopped at that point.

This is a textbook ending for a martingale strategy.

An Extremely Dangerous Combo: Martingale × Grid / Averaging Down

ForexTruck is not just a simple martingale. It also heavily incorporates a grid / averaging-down structure.

Combining a grid that stacks orders at intervals with a martingale that increases lot size as losses grow can produce large short-term gains, but it also makes unrealized losses expand extremely fast.

This combination can fairly be described as a strategy that offers “high returns in exchange for a high probability of being knocked out in one go.”

It is completely unsuitable for long-term wealth building.

Especially on small accounts with high leverage, even a single strong trend can very easily blow up the entire account.

Recheck Your Risk Tolerance Before Even Considering It

While the developer uses positive phrases like “risk control” and “flexibility,” the forward results and trade plots show the reality: a very high-risk grid + martingale EA.

If you are considering ForexTruck at all:

- Only allocate money you can truly afford to lose in full.

- Keep it completely separate from living expenses and long-term investment funds.

- Treat it as a small, short-term “experiment” at most.

Deploying it on a main account simply because “it has been growing steadily” is extremely dangerous.

Overall Evaluation and Conclusion

As shown throughout this review, ForexTruck uses a grid + martingale approach—one of the highest-risk categories in terms of blow-up potential.

While it can multiply capital in a short period, it is always exposed to the possibility of being wiped out by a single major trend.

What We Know at the Time of This Review

- The official forward accounts stopped opening new trades after the AUDUSD account effectively blew up, and all other accounts halted around the same time.

- The EURGBP account achieved gains of over +590%, but maximum drawdown was around 82%, meaning it was an account that “barely survived.”

- Trade plots reveal a clear averaging-down + martingale structure, with lot sizes ramped up while carrying large unrealized losses.

How This EA Should Be Positioned

- From the viewpoint of long-term, stable asset growth, my personal evaluation is that it is one of the worst classes of EAs.

- The risk of total account loss is very high, and you must assume that “a major drawdown will come sooner or later.”

- If you still insist on using it, the only realistic approach is a short-term, speculative trial with a small amount of money you can afford to lose—kept completely separate from living funds.

Thoughts on FOREX STORE as a Whole

The issues seen with ForexTruck are not unique. Many EAs sold on FOREX STORE use similar grid / martingale logic.

Only the accounts that happened to survive longer tend to be used for promotion, and the smooth upward curves can make them look “excellent.”

Do not be fooled by “beautiful equity curves” or “large cumulative profits.”

The key rule is: grid + martingale = risk of a one-shot account wipe-out.

For traders aiming for long-term wealth building, this EA is, overall, not recommended.

The core strategy is martingale plus grid (averaging down), putting it in the worst risk class from an investment standpoint. There are phases where maximum drawdown reaches 80–90%, and if the market gets stuck in a strong one-way trend, there is always a real chance the account gets wiped out in a single move. This is a dangerous EA that is completely unsuitable for long-term, stable investing and should be treated as “assume a total loss.”