EA Overview

| Martingale | Yes |

|---|---|

| Grid | No |

| Scalping | Yes |

| Trading Pairs | XAUUSD |

| Timeframes | 1H |

Forward Test Analysis

Current Status of Aura Ultimate EA S1: +139% in 13 Weeks

As of November 2025, the public MQL5 signal “Aura Ultimate EA S1” has been running for about 13 weeks. Starting from an initial deposit of 10,000 USD, the equity stands at 23,877 USD with a cumulative profit of 13,877 USD, which translates into a headline return of +139%. There have been 85 trades in total: 68 winning trades (an 80% win rate) and 17 losing trades (20%). The profit factor is 1.86, and on numbers alone this looks like very strong performance. The maximum drawdown on balance is shown as about 11.5%, which easily creates the impression of an EA that “grows capital quickly without large drawdowns” over the short term.

Instability Revealed by Monthly Performance and Drawdown

On the other hand, the latest monthly return is around -6.5%, and the annualized forecast is shown at roughly -79%, indicating that the most recent period has not been a simple uptrend. Looking at the statistics tab, the largest losing trade is -2,940 USD, the longest losing streak is four trades, and the maximum drawdown is 3,057 USD (around 11.5%), which shows that a small number of losing trades can generate very large losses. An 80% win rate and a profit factor of 1.86 are attractive, but we need to examine carefully whether the system has a structure where “a few losses can erase a large portion of gains.”

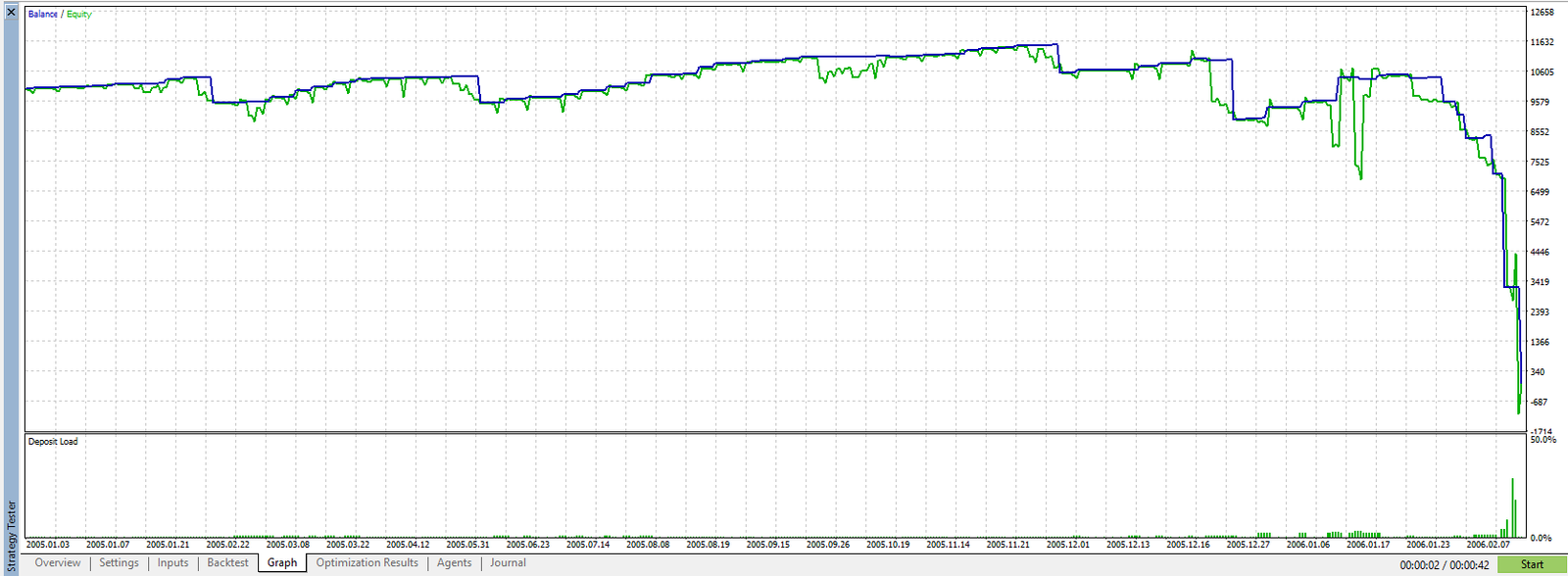

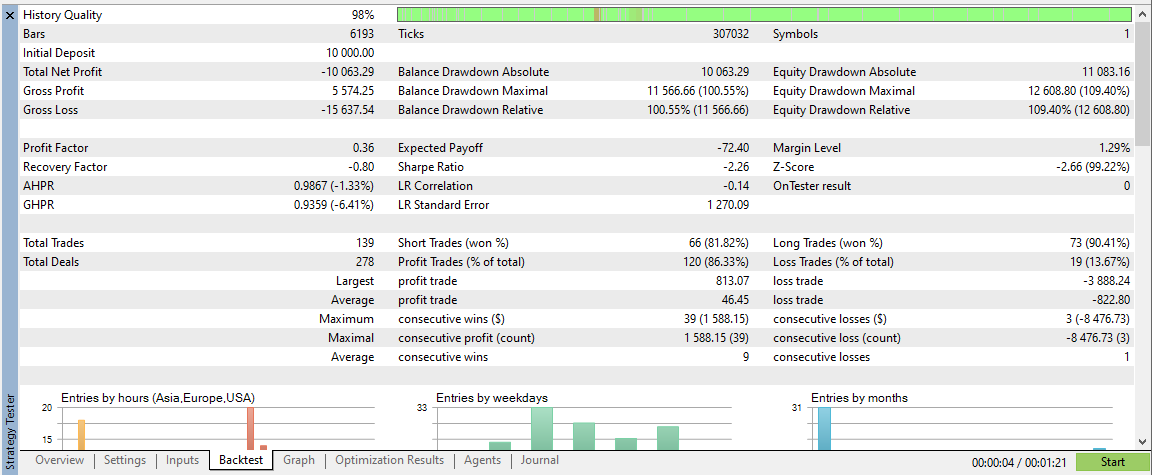

20-Year Backtest Summary: Final Balance Close to Zero

The backtest produced a total net result of -10,063.29 USD, meaning the initial 10,000 USD deposit was completely lost and a small additional loss was incurred. Breaking this down, gross profit was about 5,574 USD and gross loss about -15,638 USD, so losses outweighed profits by a wide margin. There were 139 trades in total, and 120 of them were winners, so the win rate was very high. Nevertheless, the account still ended up almost at zero—an archetypal “martingale blow-up pattern.”

The profit factor was 0.36, and the expected payoff (average profit per trade) was -72.40 USD, clearly indicating a negative-expectancy EA in the long run. Even with a high win rate, the occasional huge losses completely erase all prior gains.

Relationship Between Equity Drawdown and Lot Size

Here we evaluate drawdown using absolute lot size and equity, rather than percentages of balance. In this test, despite starting from a base lot of 0.01, the maximum equity drawdown reached about 12,609 USD. On an account that began with 10,000 USD at 0.01 lots, a drop of more than 10,000 USD from the equity peak shows just how aggressively the lot size was increased via martingale.

Looking at the equity curve, during the early to middle phase the balance appears to rise gradually, with staircase-shaped dips at each stop loss. Toward the end, however, losses pile up while the lot size is greatly enlarged, and the equity collapses almost vertically, leaving the account nearly wiped out. Once things start to break down, almost no capital remains. From a money management perspective, this design is simply unacceptable.

The “Instant Zero” Danger of Martingale

In this 20-year backtest, there are indeed phases where the equity curve resembles the smooth uptrend seen in the forward test. But in the final phase, martingale lot increases reach their limit, a series of losses hits, and the account collapses in one go. The crucial point is that this happens even with a very small initial lot of just 0.01. If you were to start a real account at 0.1 or 0.5 lots instead, the same market conditions would produce losses 10 or 50 times larger, quickly leading to drawdowns that are impossible to tolerate with real money.

The conclusion is that, although Aura Ultimate EA may appear to grow capital with a high win rate in the short term, it carries the inherent risk of account blow-up that comes with martingale systems. Over a 20-year horizon, the account fails to survive and ultimately goes completely bust. Judging this EA solely by its short-term forward results is therefore extremely dangerous.

Trading Logic and Risk Characteristics

Developer’s Description of the Strategy

According to the developer, Aura Ultimate EA is a “multi-strategy EA powered by AI and neural networks.” It is said to combine several modules—such as momentum, volatility, and adaptive filters—and switch entries and exits according to market conditions. The developer emphasizes that it does not use grid, martingale, or averaging strategies, that every position has a stop loss (SL) and take profit (TP), and that it is designed to be “safe enough” for use with prop firms.

The EA is dedicated to XAUUSD (gold) and is supposedly based on an H1-timeframe logic. At the same time, the strategy is said to incorporate multiple timeframes and internal filters, and the precise internal workings are a black box.

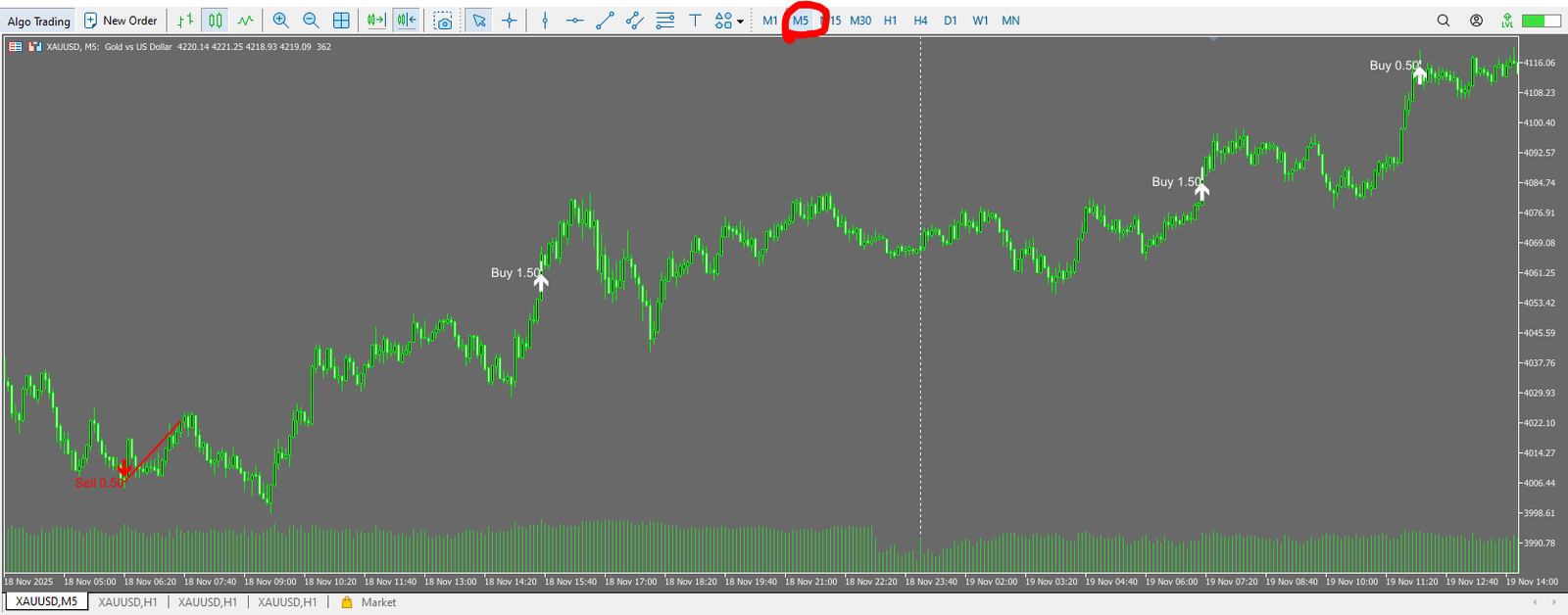

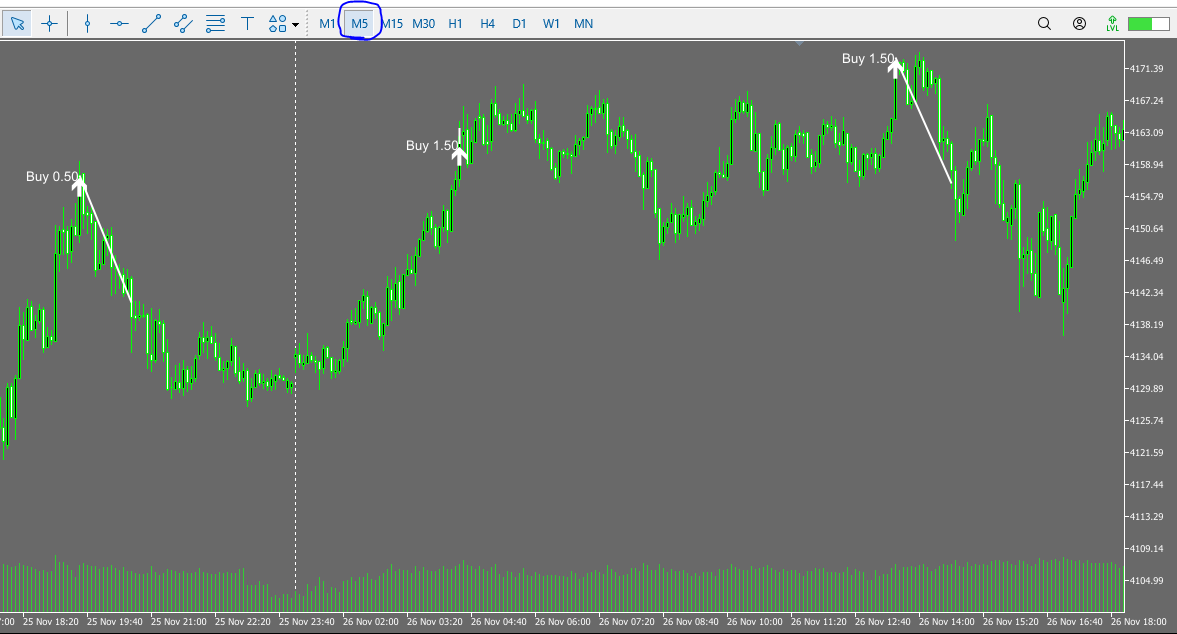

Actual Trading Pattern: Scalping for Small Profits

When we plot the real forward trades on a chart, we see that even on the M5 timeframe the take-profit distance is very small, resulting in a scalping-style trading pattern. White arrows mark buy entries/exits and red arrows mark sell entries/exits. Each position is closed relatively quickly, and the profit per trade in terms of price movement is modest.

The fact that profits are this small even on M5 suggests that the strategy is designed to “stack small gains with a high win rate.” On the flip side, such scalping-style strategies are very sensitive to spread widening and sudden spikes in volatility, and performance can deteriorate sharply when market conditions change.

Martingale Money Management: Tripling the Lot Size After Losses

Even more important is how the EA manages lot size after losses. In the forward trade history, we repeatedly see the base lot of 0.50 increased to 1.50 lots immediately after a losing trade. In many cases, the subsequent winning trade then recovers the previous loss in one go.

This is a textbook martingale approach: “increase the lot size after a loss so that one or a few wins will recoup it.” The system does not add multiple positions in a grid or averaging pattern, but the mere fact that it triples the lot after a loss to win back the drawdown means it is, for all practical purposes, a martingale EA.

Risk Summary: High Win Rate in Exchange for “One-Shot Kill” Risk

In summary, Aura Ultimate EA:

- Uses a scalping-oriented trading style that stacks small profits

- Employs martingale money management, tripling lot size after losses

- Is described by the developer as “not using martingale or grid,” but the actual behavior is martingale in all but name

In the short term, the high win rate and smooth equity curve may look impressive. However, if losses occur while the lot size is enlarged, the account balance can be slashed in a very short time. Taking both the forward test and backtest into account, the most accurate assessment is that Aura Ultimate EA is a “dangerous martingale EA that hides account-killing risk behind a high win rate.”

Overall Evaluation and Conclusion

Aura Ultimate EA delivers very attractive results in the short-term forward test, but beneath that lies the fatal risk inherent to martingale systems. The developer claims that it does not use martingale or grid strategies, but both the trade history and backtest clearly show a structure where the lot size is tripled after losses. This is not a safe EA that can be relied on for long-term operation. Combining the forward test, the 20-year backtest, and the actual trading behavior leads to the following evaluation:

Key Takeaways

- The short-term forward test shows a flashy +139% gain, but monthly drawdowns and skewed win/loss distribution reveal instability.

- Martingale behavior is confirmed, with lot size tripled after losses to “win back” drawdowns.

- The scalping-style, small-take-profit approach makes the strategy highly sensitive to spreads and sudden volatility.

- In the 20-year backtest the account collapses almost to zero in one blow, demonstrating that the system is not sustainable.

- A single configuration mistake or unexpected losing streak can instantly blow up a real account.

- The smooth upward forward curve is typical of martingale systems’ “illusory stability”.

Who Is This For?

- It may appeal to traders who “aim for high returns in a short period and can tolerate extremely high risk.”

- On the other hand, it is completely unsuitable for investors seeking stable, long-term growth.

- It is also a poor fit for prop firm challenges, where a single losing streak typically means immediate failure.

Conclusion

Judging only from the short-term forward test, Aura Ultimate EA may look like a high-win-rate, high-return EA. In reality, it is a dangerous martingale EA that aggressively increases lot size after losses and is highly likely to blow up accounts over the long run. Both the backtest and forward behavior point to the same conclusion.

Overall, this EA is not suitable for long-term operation and cannot be recommended to traders who want to grow their capital steadily over time.

In practice this EA uses a de facto martingale structure that triples the lot size after a loss. It is a scalping-style system that takes small profits with a high win rate, but a losing streak can wipe out the account in one shot. It is not suitable for long-term operation.