EA Overview

| Logic Overview | Trend-following / Machine Learning |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | Yes |

| Trading Pairs | XAUUSD |

| Timeframes | 30M |

| Developer | Aleksandar Prutkin |

Forward Test Status (as of December 2025)

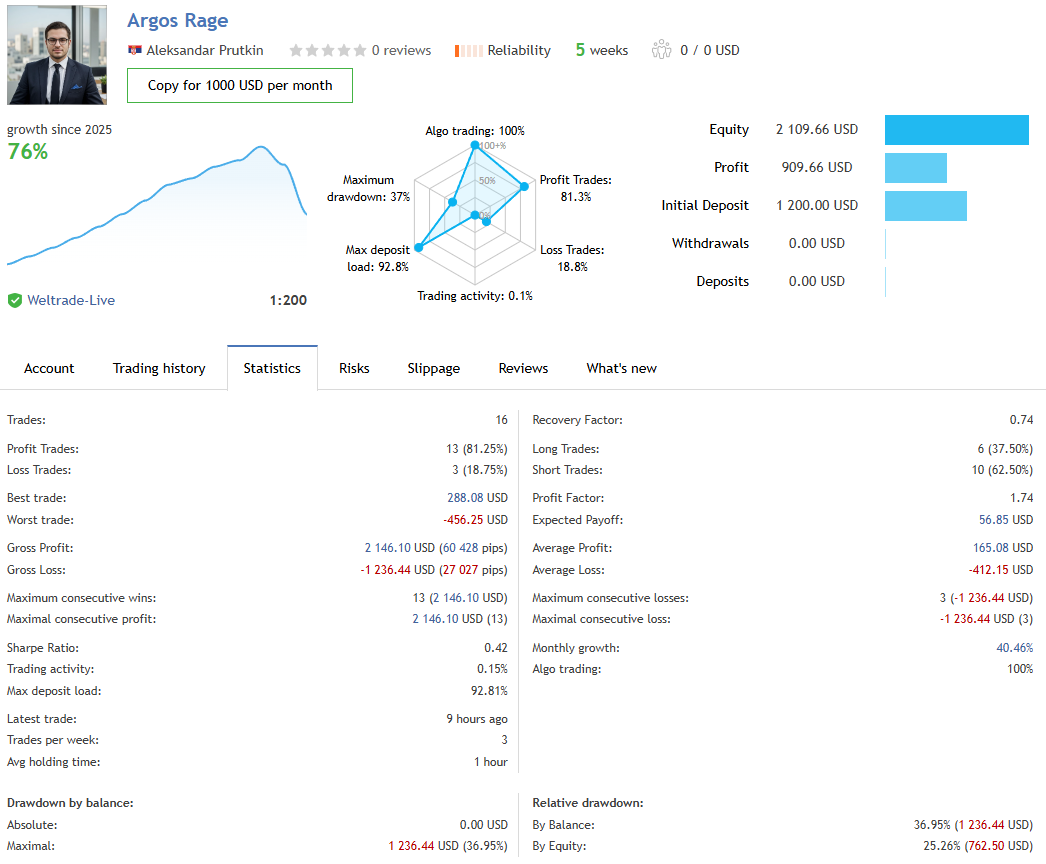

At the time of writing (9 December 2025), the official MQL5 signal for Argos Rage has only about five weeks of history and 16 trades, so the forward track record is still very short. Even so, it already shows a sharp +76% increase in equity together with a maximum drawdown of around 37% and a peak margin load of roughly 93%, which are quite aggressive numbers. Below is a summary of the forward test characteristics we can see at this stage.

Statistics for the official Argos Rage MQL5 signal. In exchange for a 76% gain over five weeks, you can already see a maximum drawdown of about 37% and a poor risk–reward profile where the average loss is much larger than the average profit.

+76% in Five Weeks, but Only 16 Trades

Looking at the account information, the broker is Weltrade-Live with 1:200 leverage. The initial deposit is 1,200 dollars and the current equity is around 2,109 dollars, which is a profit of roughly 909 dollars and a growth rate of about +76%. At first glance this looks like excellent performance, but there have only been 16 trades so far, so the statistical reliability is very low and this needs to be kept in mind.

The breakdown is 13 winning trades and 3 losing trades, giving a win rate of 81.25%. The month-on-month growth rate is also around +40%, so judged solely from these numbers, it appears to be a high-performance EA. However, there is a strong possibility that we are only seeing a short period of favorable conditions, so it is dangerous to have excessive expectations at this stage.

High Win Rate but Poor Risk–Reward: a “Slow and Steady, Then Big Hit” Profile

Looking at the per-trade profit and loss, the average profit is about +165 dollars, while the average loss is around –412 dollars. One losing trade can therefore wipe out the profits of two to three winners. The best trade gained +288 dollars, whereas the worst trade lost –456 dollars, so the risk–reward is clearly not attractive.

The profit factor is 1.74, which is not bad, but the recovery factor is only 0.74, below 1.0, meaning that the EA has not fully recovered from its largest drawdown. From the current forward data, it seems fair to say that this EA has the classic “small steady wins but heavy occasional losses” behaviour.

Aggressive Operation with 37% Maximum Drawdown and 93% Margin Load

Looking at the drawdown metrics, the maximum balance drawdown is about 36.95% (around 1,236 dollars), and the maximum equity drawdown is already about 25%, so the account has experienced fairly large swings. The maximum deposit load (margin usage) has reached 92.81%, meaning the account has been pushed close to full leverage at times.

What these numbers tell us is that the EA has the potential to grow the account quickly in the short term, but it also carries the risk of wiping out 30–40% of the equity in one episode. If you increase the lot size and run it more aggressively, only a few adverse trades may be enough to cause a catastrophic loss.

Current Assessment of the Forward Test: A Potentially High-Risk EA

Taken together, the forward performance of Argos Rage gives the impression that the short-term figures are flashy, but the combination of poor risk–reward and large drawdowns makes it a high-risk EA. In particular, the fact that the average loss is far larger than the average profit, the maximum drawdown is around 37%, and the margin load exceeds 90% are all major concerns for traders who want to run it in the long term.

The live period is still only five weeks with 16 trades, so this review is nothing more than a “snapshot of the situation so far.” A more realistic evaluation would require tracking the forward results for several more months to a year and checking how deep the drawdowns become and how the EA behaves during losing streaks. At the very least, this is not the kind of EA to pour large amounts of capital into at this stage; it is an EA that should be tested cautiously on demo accounts or with small real-money allocations.

Backtest Results (2005–2025, XAUUSD)

Forward tests alone are not enough to judge the true capability and risk of an EA, so as part of the evaluation I ran my own backtest of Argos Rage. Based on the results, this section looks at how much profit it generated and what level of equity drawdown appeared, and also touches on concerns about over-optimization.

Backtest Conditions and Assumptions

The test conditions were as follows:

- Period: 1 January 2005 to 28 November 2025 (about 20 years of data)

- Symbol: XAUUSD

- Initial deposit: 10,000 USD

- Lot size: fixed 0.01 lots

- Other settings: left at default

- Spread: 40 points

This is effectively a “long-term, fixed-lot, slightly wide spread” setup, intended to make the test somewhat stricter than typical live trading conditions. With that in place, we can see what kind of profit and equity behaviour emerged over the 20-year period.

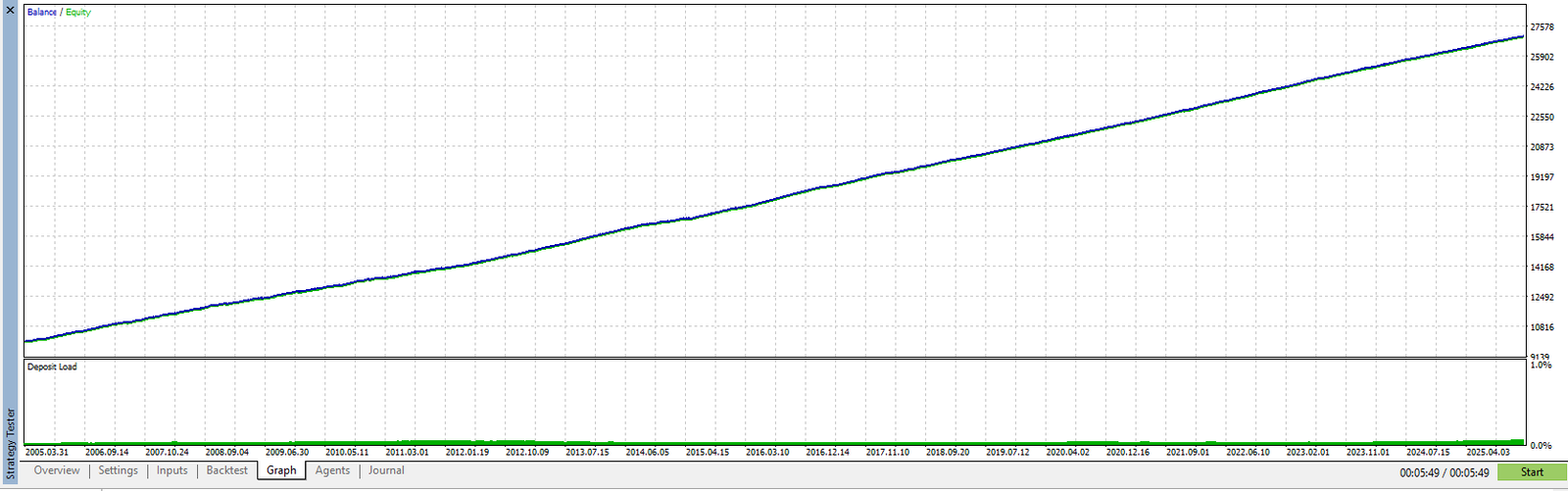

Balance up About 2.7x in 20 Years with a “Perfect” PF of 6.45

The results show that with an initial 10,000-dollar deposit, the net profit was about 17,027 dollars, and the final balance rose to just under 27,000 dollars. Given the 20-year test period, the annualized return is not spectacular, but the equity curve is extremely smooth and upward-sloping, a textbook example of a “beautiful balance curve.”

Looking at the statistics, there were 6,006 trades in total, the profit factor was 6.45, and the win rates for both long and short positions were around 94%. A profit factor above 6 combined with a win rate in the 90% range would normally be considered exceptionally strong.

Maximum Equity Drawdown Only About 76 Dollars

On the risk side, the maximum equity drawdown was about 75.69 dollars, and even on an absolute basis, equity drawdowns remained within tens of dollars over the entire 20-year period. The lot size stayed at a fixed 0.01, and the deposit load (margin usage) hovered close to zero, giving the impression of “trading quietly with a tiny lot size and almost no damage.”

The fact that the absolute equity drawdown is extremely small relative to the lot size can be interpreted as “very safe,” but it also means that the test was run under extremely conservative risk settings. In practice, raising the lot size could easily change the behaviour, particularly the size of floating drawdowns.

Poor Risk–Reward, Relying Heavily on Win Rate

Looking at the profit and loss distribution, the average profit is about 3.56 dollars, while the average loss is about –9.10 dollars. One losing trade wipes out roughly 2.5–3 winning trades. The maximum loss is –11.70 dollars, clearly larger than the maximum profit per trade, so the raw risk–reward is far from ideal.

Despite this, the system ends up strongly profitable because around 94% of all trades are winners. In other words, this backtest shows a system that “accumulates many small wins while occasionally accepting larger losses,” and the poor risk–reward ratio is being offset by an unusually high win rate.

Near-Perfect Backtest Raises Over-Optimization Concerns

Taking all of these numbers and graphs together, the backtest for Argos Rage looks like a near-perfect result where the equity curve climbs for 20 years with almost no damage. In reality, however, markets are affected by changing spreads, slippage, leverage rules and shifts in gold volatility, all of which differ from the backtest environment.

Given that equity drawdowns in the backtest are only on the order of tens of dollars and that an extremely high profit factor of 6.45 and a 94% win rate persist for such a long period, it is hard not to suspect that the system may be heavily optimized to this specific 20-year dataset. And because the test uses a fixed 0.01-lot size, it is difficult to infer how the system would behave with larger lots, especially in terms of floating losses.

In summary, this backtest tells us that if you keep the lot size extremely low, the past 20 years would have allowed you to accumulate profits with almost no pain. But there is no guarantee that this will hold in future markets. In fact, the closer a result looks to perfection, the more we should assume over-optimization risk and treat forward tests and demo trading as essential before committing real capital.

Trading Logic and Risk Characteristics

This section organizes the trading style and risk structure of Argos Rage based on the developer’s description of the logic and what can be observed from the forward trade history charts.

Developer’s Description of the “AI Logic”

According to the developer, Argos Rage uses a proprietary logic called “DeepSeek AI” to analyse the market’s structure, rhythm and pressure in real time and make trading decisions. It mainly targets XAUUSD and EURUSD, and is described as capturing trend continuation and short-term pullbacks to accumulate small price moves.

The developer also states that no grid or martingale is used. Instead of pyramiding losing positions, the EA is supposed to operate with essentially independent trades, one entry at a time. Every trade is said to have a stop loss and take profit set in advance, making it a scalping-style EA.

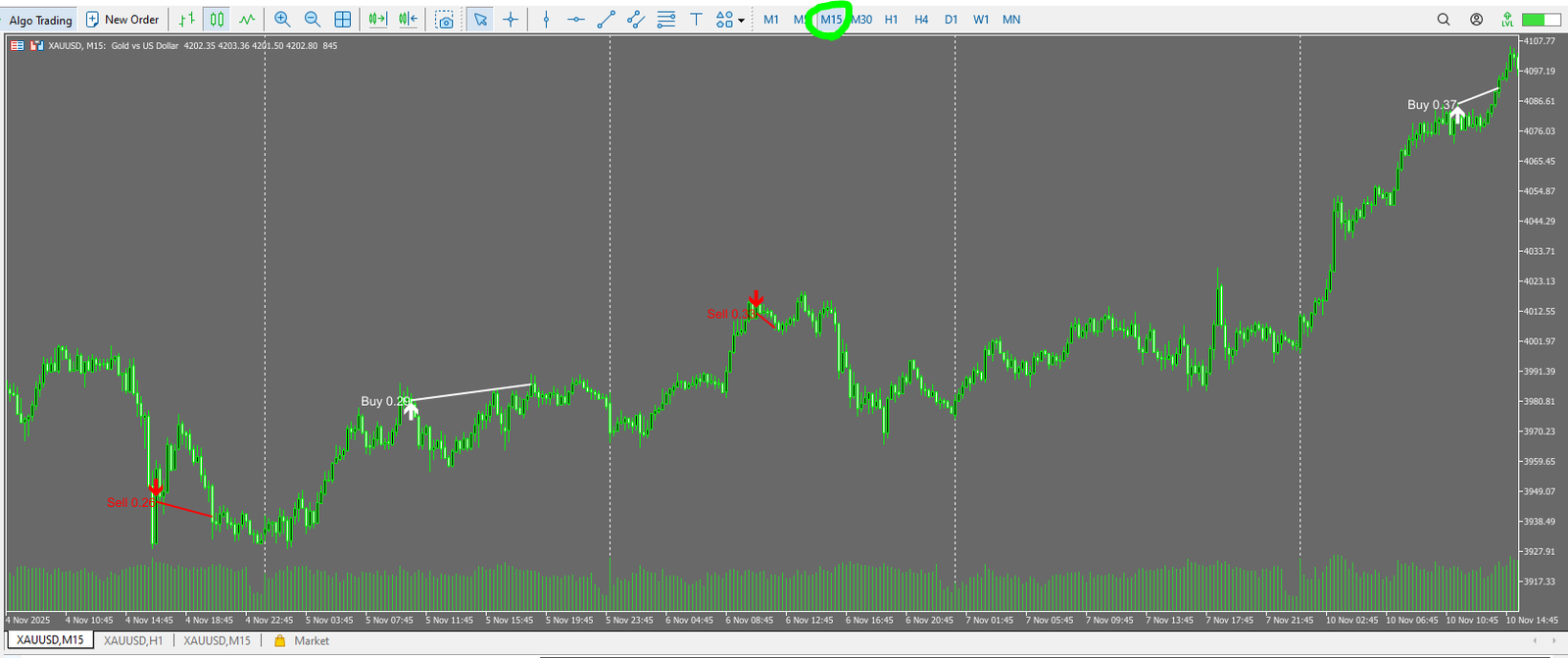

Entry Characteristics Observed in the Forward Trade History

In the actual forward trade history charts (white arrows for buys and red arrows for sells), entries appear to follow momentum on both the M15 and H1 timeframes. We can see long entries after strong declines aiming to catch a rebound, and short entries around potential tops after sustained rallies, indicating that it often targets short-term trends and reaction points.

There is no sign of positions being layered step by step in a staircase pattern. Instead, it mostly looks like the EA opens and closes one trade at a time based on its judgement at that moment. At least from what we can see in the forward data, this supports the view that it is not using a grid or martingale-style averaging strategy.

At the same time, the lot size varies between roughly 0.2 and 0.5 lots depending on market conditions, suggesting that the EA adjusts position size according to volatility and its internal signals.

Scalping for Small Moves, but Slow to Cut Losses

Combining the forward statistics and charts, Argos Rage clearly behaves as a scalping EA that aims to accumulate small profits. Many winning trades take profits at relatively shallow levels and close quickly, building gains bit by bit.

However, stop losses tend to be late, and losing trades often incur relatively large losses. The statistics show average losses larger than average profits, and the charts reveal trades that go against the trend, sit in floating drawdown for a while, and then get closed with a sizeable loss when the stop is finally hit.

In other words, Argos Rage is a “small profit, large loss” EA. Instead of increasing the number of positions with grid or martingale, it takes wider stops on each trade, accepting occasional large losses in exchange for a high win rate.

Risk Summary: High-Win-Rate Scalping with Tail Risk

Overall, the trading logic and risk characteristics of Argos Rage can be summarized as follows:

- No grid or martingale; it generally uses single, independent entries.

- A scalping style that targets small price moves with a relatively high win rate.

- Losses are cut late, so a single losing trade can erase several winners, creating a small-profit, large-loss structure.

- Raising the lot size makes occasional large stop-loss events much more damaging for the entire account.

The absence of grid and martingale may look reassuring at first glance, but the combination of high-win-rate scalping and small-profit, large-loss behaviour inherently carries tail risk: when market conditions change, a single episode can produce a very large loss. Anyone running this EA should keep lot sizes modest, ensure they have enough spare capital to withstand unexpected moves, and monitor the forward results carefully over time.

Overall Assessment and Conclusion

Argos Rage is a high-win-rate scalping EA that advertises AI-driven logic, but both the forward and backtest results suggest it is a high-risk EA that embeds a “small profit, large loss + tail risk” profile. The key points are summarised below (all observations are based on data available as of December 2025 and should be treated as a provisional review).

Key Evaluation Points

- In the forward test, it delivered a flashy +76% return over roughly five weeks, but with only 16 trades the statistical reliability is still very low.

- The 20-year fixed-0.01-lot backtest shows an extremely smooth upward equity curve with PF 6.45 and a win rate above 94%, which looks “too perfect.”

- At the same time, the average loss is much larger than the average profit and stop losses are slow, meaning the design relies heavily on a very high win rate.

- Although it does not use grid or martingale, increasing the lot size makes the occasional large stop-loss events potentially very damaging for the account.

- The “perfect” nature of the backtest raises a serious possibility of over-optimization to historical data.

Who Is This EA For?

- Traders who want to experiment with a high-win-rate scalping EA using small or test funds.

- Those familiar with gold (XAUUSD) volatility and mentally prepared to tolerate drawdowns and temporary floating losses.

- Traders looking to add an aggressive component to a diversified EA portfolio, rather than long-term investors seeking stable, low-risk growth.

Points to Watch When Using It

- Do not oversize the lots. Start with demo or very small real-money positions and observe the forward behaviour first.

- Estimate in advance how much equity could be lost during losing streaks or large stop-loss events.

- Because results can change significantly depending on broker and execution conditions (spread, commission, slippage), re-testing in your own environment is essential.

Conclusion

Argos Rage may look like a “dream EA” at first glance thanks to its headline numbers and the AI marketing angle, but a closer look reveals an aggressive scalping EA with poor risk–reward and meaningful tail risk. This type of EA is always shadowed by the possibility of over-optimization. Rather than jumping in immediately, it is wiser to keep watching the forward performance over time and then carefully decide whether it deserves a place in your trading portfolio.

Argos Rage is a high–win-rate scalping EA that trades with single entries and does not use grid or martingale, but its take-profits are shallow and stop losses are triggered very late. If you increase the lot size, there is a real risk of heavy damage to the whole account. It should be viewed as an aggressive EA with small profits, large losses, and significant tail risk.