EA Overview

| Logic Overview | Breakout |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | Yes |

| Trading Pairs | XAUUSD |

| Timeframes | 1H |

| Developer | Ho Tuan Thang |

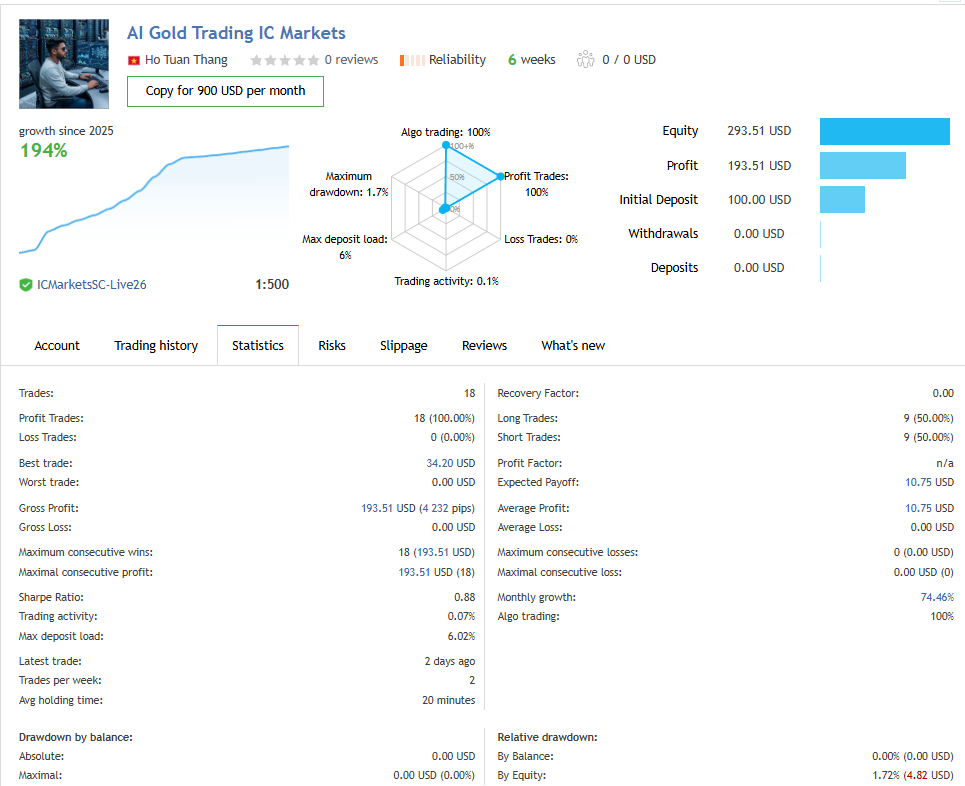

Forward Test Analysis: Still in an Early Phase With No Losses Yet

A Flashy Start: +194% and 100% Win Rate in Six Weeks

For the official signal “AI Gold Trading IC Markets,” the account grew from an initial balance of $100 to $293.51 in about six weeks, resulting in a very eye-catching growth of around +194%.

The number of trades is still small at 18 trades, but so far we see 18 wins and 0 losses (100% win rate), and the maximum drawdown on equity is only about 1.7%. Looking at the graph alone, the equity curve appears very stable and smoothly upward.

The trading frequency is about two trades per week, with an average holding time of around 20 minutes. This places the strategy somewhere between scalping and short-term day trading. With 1:500 leverage and an initial deposit of just $100, the forward results present the EA as something that can “grow a small account quickly,” at least on the surface.

No Stop-Losses Yet = The Real Risk Is Still Invisible

However, there is an important caveat to this forward performance:

So far there has not been a single stop-loss trade.

In the statistics, the number of losing trades is zero and the average loss is also $0, which means we have no information at all about key points such as:

- How far price can move against the position before a stop is hit

- How large the loss will be when a stop-loss is finally triggered

A forward history that consists only of winning trades like this can often be interpreted as the early phase of a typical “small wins, big loss” EA. If the stop-loss distance is set very wide, it may simply be that price has not yet moved far enough against the positions to hit it. At some point, there is a real risk that we will see one large stop-loss (or a streak of losses) that wipes out the small profits accumulated so far.

It is therefore dangerous to look at this signal alone and conclude that it is a “low-risk, high-win-rate EA.”

With Only 18 Trades, There Is No Basis for Long-Term Edge

Another issue is the small sample size. The forward period covers only about six weeks and 18 trades, which is nowhere near enough data to declare that the EA has a positive long-term expectancy. For example, it is entirely possible that the first 18 trades just happened to be winners, and that the equity curve will quickly collapse once a few large stop-losses occur.

This risk is even more pronounced for complex EAs like AI Gold Trading MT5 that may reference external APIs or news feeds: their behavior can change with market conditions or with changes to the external services. We must therefore assume that the current forward results might simply be a short-term sample taken during a favorable market phase, and evaluate them with plenty of skepticism.

Current Conclusion: Too Early to Rely on This Forward Alone

In summary, the forward test of AI Gold Trading MT5 is:

Visually impressive, but still in an early stage with no stop-losses yet and a non-negligible chance of being a small-wins, big-loss EA.

At present, it is just one example of an attractive initial performance, and using it as the sole basis for high-lot real trading would be very risky. For a proper evaluation, it is safer to wait for:

- At least several months to half a year of forward data, and

- Dozens to hundreds of real trades

In addition, you should confirm the backtest results, the maximum expected loss, and how much capital would be lost in a single stop-loss event before making any decision.

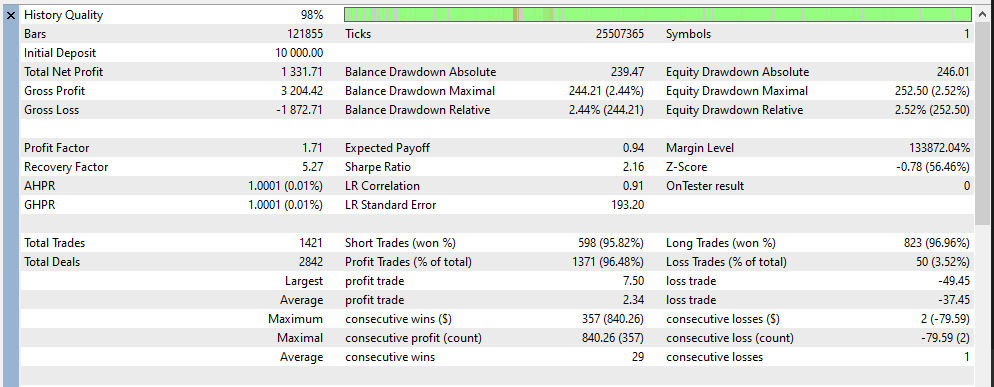

Backtest Analysis

Backtest Conditions and Assumptions

To avoid relying solely on the developer’s published results, I ran my own backtest using the MT5 Strategy Tester. The conditions were as follows:

- Period: 1 January 2005 – 28 November 2025 (about 20 years of data)

- Symbol: XAUUSD

- Initial deposit: 10,000 USD

- Lot size: fixed 0.01 lots

- EA parameters: all left at default values

- Spread: 60 points

History quality was displayed as 98% with about 25.5 million ticks, which is sufficiently accurate for a long-term test.

About +$1,300 Profit Over 20 Years

In this backtest, the final total net profit was about $1,332.

Given the initial deposit of $10,000 and the conditions of a fixed 0.01 lot and 60-point spread, this is a level that can be described as “not losing money, but not growing aggressively either.”

The profit factor is 1.71. Statistically, the EA does win more than it loses, but it is far from a system that delivers explosive returns; the result is more like “it might gradually grind higher over the long term.”

Extremely Poor Risk–Reward Ratio

The statistics reveal the skewed risk–reward profile clearly:

- Average profit: about +$2.34

- Average loss: about -$37.45

- Largest profit trade: +$7.50

- Largest loss trade: -$49.45

In other words, a single loss can wipe out the profits from more than ten wins. The win rate is extremely high at around 95% for both long and short trades, but because each losing trade is so large, the backtest frequently shows patterns where one stop-loss almost completely cancels out a long stretch of small gains.

In this test we used a fixed 0.01 lot, so the maximum equity drawdown is limited to about $246. If we simply scaled the same logic up to 0.10 lots, the theoretical maximum equity drawdown would be about $2,460; at 1.00 lot it could reach $24,600.

For this reason, it is dangerous to think only in terms of drawdown percentage relative to account balance. You must always evaluate risk in terms of lot size and absolute dollar drawdown.

Long Period of Stagnation From Around 2005 to 2015

Looking at the equity curve over the entire period, you can see that during the roughly ten years from 2005 to around 2015 the curve is almost flat and choppy. Small profits are built up, then erased by larger losses, and the overall graph looks like a series of round-trips.

From about 2015 onward, the curve begins to look more consistently upward, but this may simply reflect the fact that the EA’s logic happened to work well in that particular market environment. It does not mean that the EA has consistently made money under all market conditions since 2005.

Overall, the backtest suggests that the edge is not constant over time and seems to appear only in specific market regimes.

What the Backtest Tells Us

From this backtest we can summarise the characteristics of the EA as follows:

- Even under the relatively strict condition of 0.01 lots and 60-point spread, it did end up profitable over about 20 years.

- However, most of the profit structure is “many small wins with occasional big losses,” and the risk–reward ratio is extremely poor.

- The maximum equity drawdown of about $246 is small in absolute terms, but it scales almost linearly with lot size.

- From around 2005 to 2015, the account barely grew at all, which suggests the EA’s performance is heavily dependent on specific market environments.

Therefore this backtest supports the view that:

The EA may survive in the long run if lot size is kept very small, but its poor risk–reward profile means there is always a risk that one loss will wipe out years of profits.

If you plan to use it, you must carefully examine lot size and drawdown in absolute monetary terms and decide in advance “how much loss you can tolerate from a single stop-loss event.”

Trading Logic and Risk Characteristics

Core Concept: A Breakout-Side Scalping EA

AI Gold Trading MT5 is a breakout-side scalping EA for XAUUSD on short-term charts.

According to the developer, the concept is to enter quickly in the direction of a range breakout and capture small profits. Position size is small and the number of positions is not large, but the stop-loss is set relatively wide compared to the take-profit, resulting in a high-win-rate but poor risk–reward structure.

How Entries Look on M15

Plotting the forward trade history on the 15-minute chart (M15), white arrows represent Buy entries and red arrows represent Sell entries.

- Sell trades tend to appear as pullback sells after a strong rise or as breakout sells after support is broken.

- There are also some Buy trades after declines or resistance breakouts, but they are less frequent.

- This is not a hyper-frequent scalper that trades dozens of times per day, but rather a low-frequency scalping EA that enters only when it sees a clear opportunity.

On the chart, the EA seems to ride trends fairly well when they develop cleanly, but when the breakout turns out to be false, the trade is often dragged all the way to the stop-loss, resulting in a heavy loss.

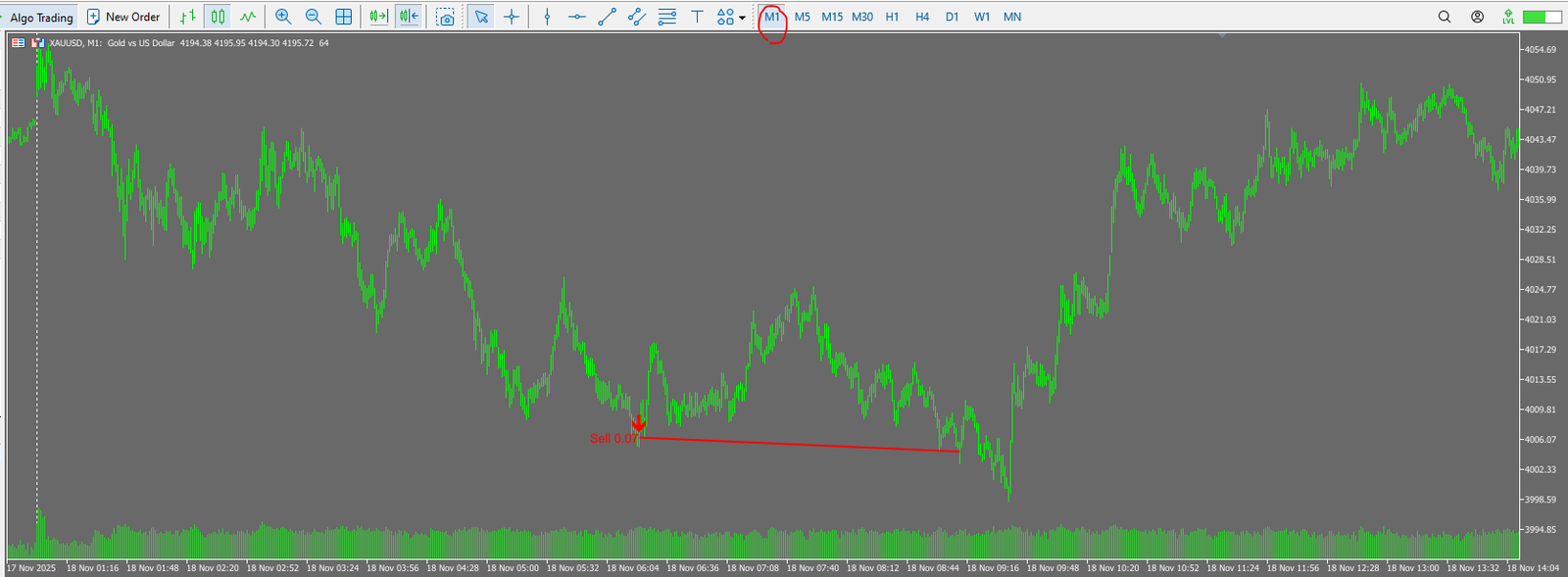

How Losing Trades Develop on M1

When we zoom in on one of the Sell trades on the 1-minute chart (M1), we can see the position being held for a long time before finally closing with a large loss.

- A Sell position of 0.07 lots is opened in the breakout direction.

- Price then slowly moves against the position, alternating between sideways and mild declines, with the position left open.

- Eventually, price hits the wide stop-loss level and the trade is closed with a large negative result in one go.

In other words, the EA is designed so that take-profit targets are only a few dollars and are collected frequently, while stop-losses are tens of dollars and occur as big one-off hits.

The backtest statistics – average profit of about $2.34 versus average loss of about $37.45 – confirm this pattern, where one losing trade can erase the profits from many winners.

Developer’s Stated Logic (Official Description)

According to the developer, the EA is designed based on the following ideas (this is their claim, not an independent verification):

- Detect breakout direction using volatility and price zones such as recent highs and lows.

- Apply filters to noise and enter only on strong price movements for scalping.

- Each position has a fixed take-profit and stop-loss, with no martingale, grid, or averaging down.

- The concept is to maintain a high win rate while targeting stable long-term returns.

The concept itself is easy to understand as a “scalper that quickly rides range breakouts,” but in practice you must pay close attention to how wide the stop-losses are.

Summary of Risk Characteristics

Combining the forward history and backtest results, the risk characteristics of this EA can be summarised as:

- A breakout-side scalping EA whose stop-losses are very wide, making each loss very large.

- High win rate but poor risk–reward, with a typical “small wins, occasional big loss” pattern.

- Works well on days with clean trends, but tends to incur large losses in choppy or false-breakout markets.

- The larger the lot size, the faster the monetary size of each loss grows, greatly increasing the risk of losing a large portion of the account in a single event.

In short, this EA can feel great when riding a breakout, but because of its poor risk–reward profile, it always carries a significant risk of a single large loss.

If you choose to use it, you should keep lot size extremely small and clearly define in advance, in dollar terms, how much you are willing to lose on one stop-loss trade.

Overall Evaluation & Conclusion

Overall Evaluation

- AI Gold Trading MT5 is a scalping EA that trades in the breakout direction on XAUUSD.

- It has a simple structure with fixed TP and SL per position and no martingale or grid, but its wide stop-loss and extremely poor risk–reward ratio are major weaknesses.

- In the roughly 20-year backtest, total profit is about +$1,300 – a modest result that “doesn’t lose, but doesn’t grow much either.”

- From around 2005 to 2015 the equity barely rises, suggesting that it may only work well in specific market environments.

Advantages

- Because it does not use martingale, grid, or averaging down, it is not an EA that accumulates massive floating losses.

- The win rate is high and it aims to collect small profits repeatedly, so it can feel comfortable to trade when trends are clean.

- If lot size is kept very small, it can be used as a secondary test account to study breakout scalping behavior.

Disadvantages & Risks

- Average loss is more than ten times the average profit, so it easily becomes a “small wins, big loss” EA where one loss wipes out a long sequence of wins.

- In the backtest, maximum equity drawdown is about $246, but this grows directly with lot size and can quickly become severe at higher risk levels.

- The long stagnation period from 2005 to 2015 indicates that its edge is not consistent.

- It does not suit traders who want “stable asset management” or a “set-and-forget low-risk EA,” and is not appropriate for main accounts or high-lot trading.

Who Is This EA For?

- Advanced traders who understand breakout scalping and the “small wins, big loss” risk profile, and who are willing to test it with only a small portion of spare capital and very low lot sizes.

- It is not recommended for those who want to minimise drawdowns or seek a smooth, long-term upward equity curve.

Conclusion

AI Gold Trading MT5 EA has a visually impressive win rate, but its risk–reward profile is very poor, and there is always a risk that a single large stop-loss will erase a long period of steady profits.

If you decide to use it, keep lot size extremely small, clearly define in monetary terms how much you are prepared to lose on one stop-loss, and treat it cautiously as a tool for experimentation on a sub-account rather than a core, long-term investment solution.

This EA does not use martingale, grid, or averaging down, but it has a wide stop loss and an extremely poor risk–reward profile. Even with just 0.01 lots, a single losing trade can wipe out the profits from more than ten winners. Increasing the lot size can cause one loss to inflict massive damage on the account. It is suitable only for traders who fully understand this “small wins, occasional big loss” risk profile.