EA Overview

| Logic Overview | Breakout |

|---|---|

| Martingale | No |

| Grid | No |

| Scalping | No |

| Trading Pairs | XAUUSD |

| Timeframes | 1H |

| Developer | Pablo Dominguez Sanchez |

Forward Test Analysis

Overview of the “Pivot Killer Small Account” Signal

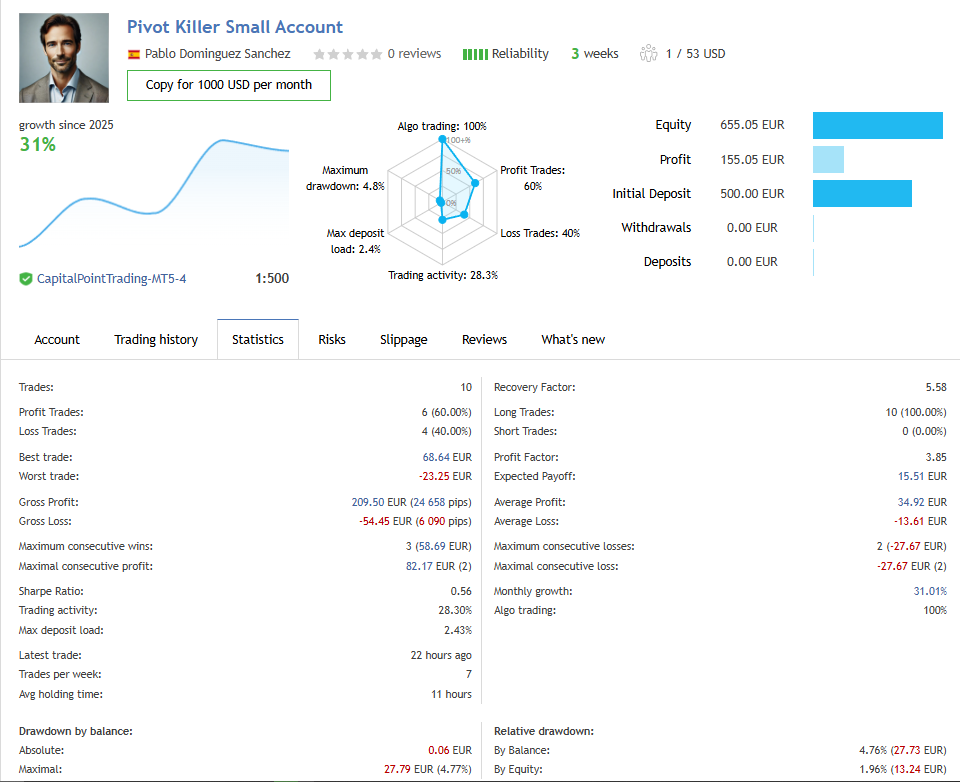

As of the time of writing (December 2025), the developer, Pablo Dominguez Sanchez, is running a live signal called “Pivot Killer Small Account.”

The initial balance is 500 euros, and after about three weeks of trading the account shows a gain of roughly 31% (balance 655.05 euros). The number of trades is only 10, so this is nothing more than an initial forward snapshot. In other words, there is far too little data to draw firm conclusions.

Profits Driven More by Risk–Reward Than Win Rate

Across the 10 trades, there were 6 winners and 4 losers (60% win rate), which is not particularly high in itself. However, the system has a small-loss/large-profit profile where the average profit clearly exceeds the average loss.

Comparing the best and worst trades shows that

“a single winning trade is significantly larger in monetary terms than a single losing trade,”

which confirms the edge is coming from risk–reward rather than win rate.

As a result, the current profit factor is around 3.8, meaning that even with a few losers the account remains comfortably profitable overall. This lines up well with the concept the developer emphasizes on the product page:

“long-term, positive expectancy based on asymmetric risk–reward rather than high win rate.”

Non-Grid, Non-Martingale Entries and Position Management

Looking at the trade history and the lot progression, there is no sign of grid trading (stacking many trades at once) or martingale (doubling the lot size after losses).

As described by the developer, Pivot Killer

is designed so that “each trade has a fixed risk with a clearly defined stop loss.”

Forward behavior supports that this is not the type of EA that holds large floating losses for prolonged periods.

Compared with grid/martingale systems that often show flashy short-term profits but a high risk of account blow-up, this design is a positive point for long-term robustness.

Interim Takeaway: A Start That Matches the Concept, but Still Too Early to Judge

The key point is that the forward sample is extremely short: three weeks and 10 trades.

With such a small data set, it is impossible to declare that “Pivot Killer is a trustworthy long-term EA.”

To understand how it behaves in different market regimes, you would need several dozen to several hundred trades.

On the plus side, the small-loss/large-profit structure and the non-grid, non-martingale design described by the developer are indeed reflected in the current forward results.

That said, a strategy that is structurally skewed toward asymmetric risk–reward should, over time, show a win rate below 50% and a more modest profit factor (typically below 2.0). A low win rate and a realistic profit factor are not bad at all—in fact, they are healthy characteristics for this style—but it means that the current forward results are probably “too good” and should be treated as such. It would be a mistake to assume that this short-term performance will simply continue indefinitely.

It is also important to remember that, in the long run, results are unlikely to exceed the backtest; at best they converge toward it. For details, see the backtest section below.

Backtest Analysis

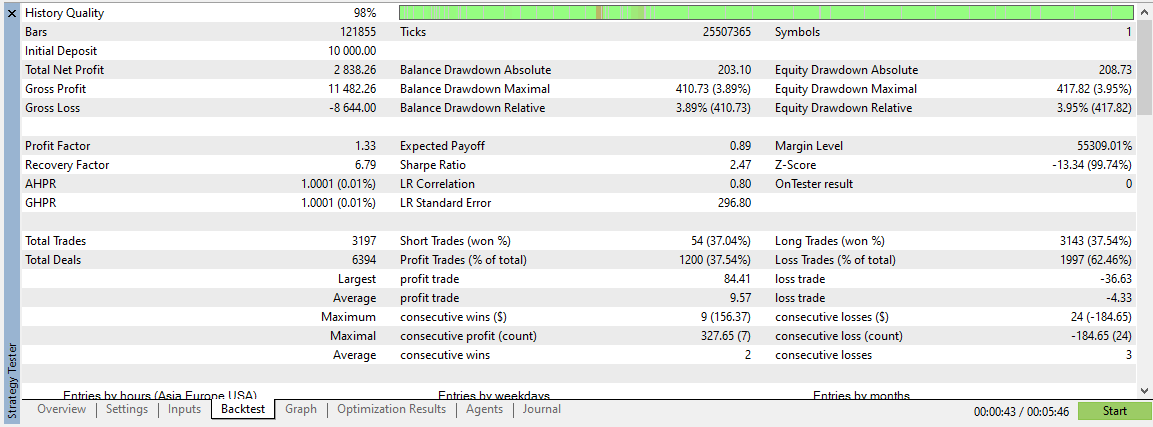

Backtest Conditions and Assumptions

To verify the developer’s claims and compare them with the forward performance, I ran my own backtest in MT5 under the following conditions:

- Period: 1 January 2005 – 28 November 2025 (about 20 years of data)

- Symbol: XAUUSD

- Timeframe: H1

- Initial deposit: 10,000 USD

- Lot size: fixed 0.01 lot (no martingale)

- Other settings: basically default

- Spread: 60 points

Because the test uses 20 years of H1 gold data with real ticks, it took more than an hour to complete and was extremely heavy. Even so, it is worth running this kind of test at least once using your own broker’s historical data.

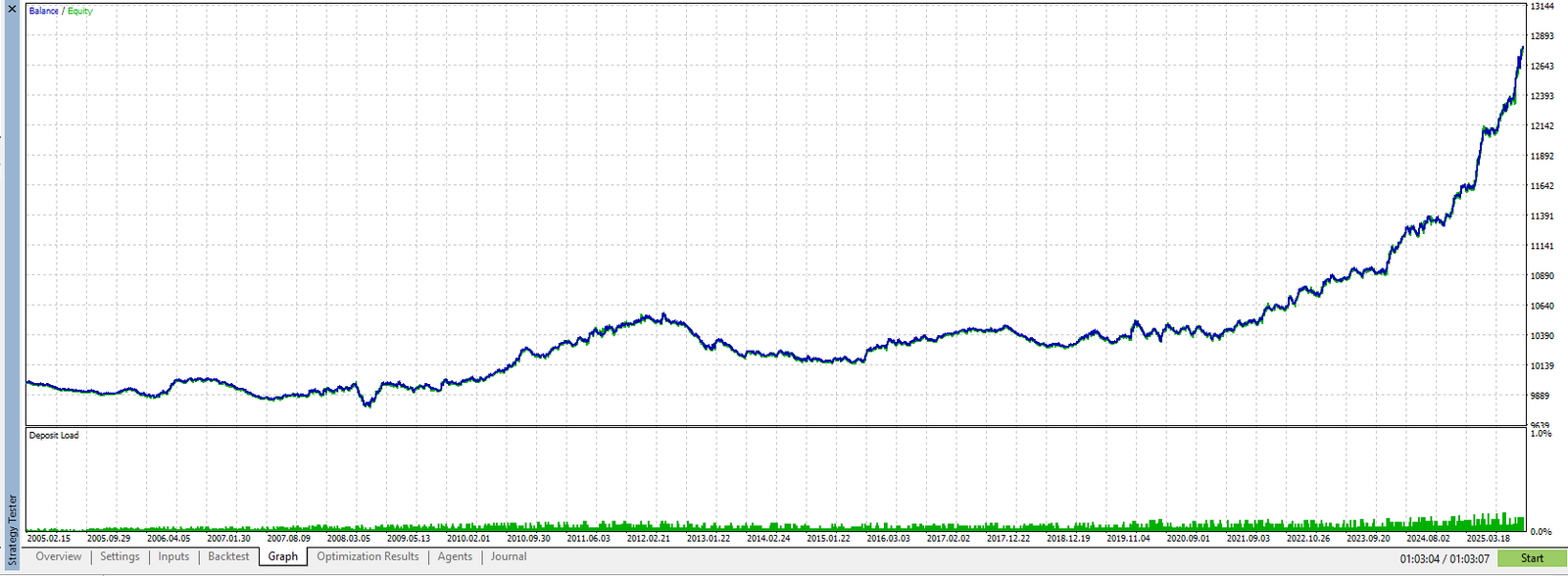

Overall Shape of the Equity Curve

Looking at the balance and equity curves, from around 2005 to 2019 the system shows mild ups and downs, with long periods of gentle up-sloping or sideways movement. After that, from 2020 onward, the curve turns sharply higher. This matches the long-term gold uptrend that started in 2020.

The trade statistics also show that the EA is heavily biased toward long positions. When gold trends strongly higher, the balance grows aggressively. On the other hand, during corrections or downtrends the balance stagnates and long flat periods appear. In other words, it is best viewed as a strategy that

“assumes a long-term bullish bias in gold and builds positions on pullbacks and trend resumption.”

Small-Loss/Large-Profit Structure Confirmed in the Backtest

According to the backtest report, there were 3,197 trades in total. Of these, about 1,200 were winners (win rate in the high-30% range) and around 2,000 were losers (in the low-60% range), so the win rate itself is not particularly high.

Even so, the final net result is +2,838.26 USD, with a profit factor of 1.33. Moreover,

“average profit > average loss” and “largest winning trade > largest losing trade,”

showing that the small-loss/large-profit risk–reward structure is clearly present in the backtest as well.

This lines up with both the forward test and the developer’s description: Pivot Killer is not a

“high-win-rate, small-profit EA,”

but rather a strategy where a single sizeable winner makes up for a string of smaller losses.

Evaluate Drawdown in Lots and Absolute Dollar Terms

When evaluating drawdown, using relative drawdown in percentage terms can be misleading because it depends heavily on the initial balance and lot size. In this test, we used a fixed 0.01 lot, so the focus was on

the absolute value of the equity drawdown (in dollars) and the associated lot size.

The maximum equity drawdown is roughly just over 400 dollars. For such a small 0.01-lot position, this is relatively moderate. However, if you scale up the lot size to 0.1 or 1.0, the monetary drawdown will grow almost linearly, so this must be taken into account.

When considering live deployment, it is strongly recommended to base your risk on “the lot size you actually intend to use” × “the maximum equity drawdown observed in your backtests.” Check carefully whether that absolute drawdown fits your account balance and acceptable loss.

Cost of Testing and Practical Considerations

With the settings above, running 20 years of H1 gold data on real ticks took more than an hour. It is a heavy test, but rather than simply trusting the developer’s backtest screenshots, it is well worth

running a similar-length backtest using your own broker’s history and execution conditions at least once.

For a strategy like Pivot Killer that relies heavily on the bullish bias in gold, it is particularly important to check for yourself:

“how much floating loss and drawdown occurs during corrections,” and

“how sensitive the results are to changes in broker and spread conditions.”

Doing this ahead of time will significantly reduce stress during live trading.

What We Can Read from the Backtest So Far

Overall, the fixed 0.01-lot, 20-year backtest suggests that:

- The EA can generate substantial profits when gold is in a clear uptrend.

- During downtrends or long ranges, the balance tends to stagnate for extended periods.

- The win rate is not high, but the small-loss/large-profit design keeps the long-term result slightly positive.

- Drawdowns are relatively modest at 0.01 lot, but will naturally scale up if you increase the lot size.

This is still just one test with a single lot size and parameter set, so it does not prove that the EA will keep working for the next 20 years. Nevertheless, the backtest behavior is at least consistent with the developer’s concept of “small-loss/large-profit, trend-following on gold, no grid, no martingale.”

Trading Logic and Risk Profile

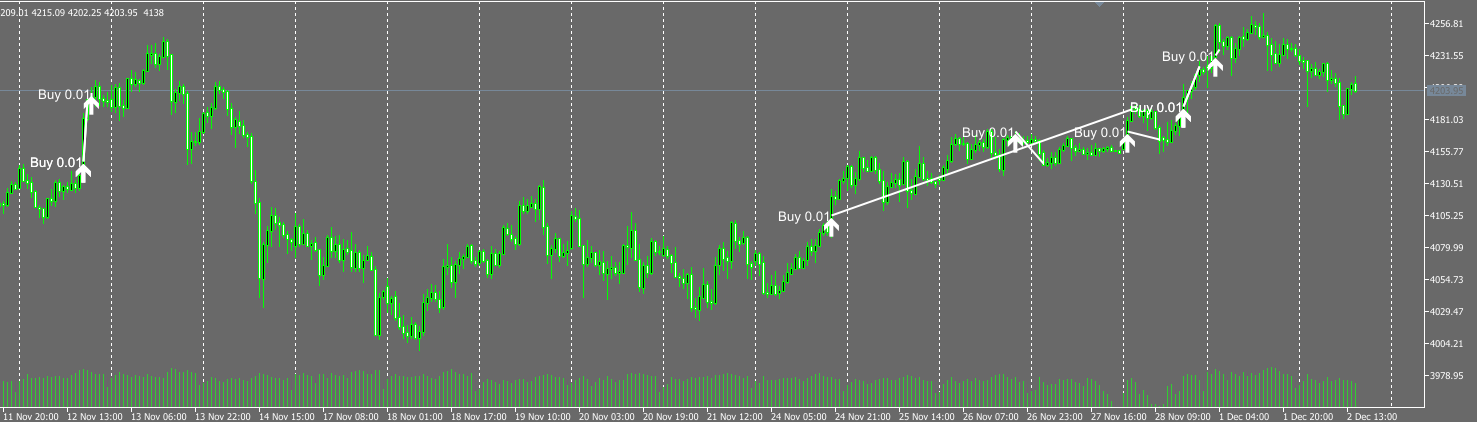

Entry Strategy: Breakout-Driven Entries

According to the developer, Pivot Killer uses a breakout-based entry logic. It opens positions when the gold price clearly breaks through certain levels, aiming to capture the subsequent trend continuation.

The chart below plots the trade history from the forward test. White arrows indicate buy entries and red arrows indicate sell entries (in this period, almost all are buys). You can see how the EA adds 0.01-lot buys step by step in an uptrend, aiming to capture the move after the breakout.

A System Built on Three Combined Logics

The developer explains that Pivot Killer combines three different logics. While the exact algorithms are not disclosed, they can roughly be thought of as:

- A module that detects candidate breakout zones

- A filter module that checks volatility, session timing, and other conditions to decide “whether this is a valid opportunity”

- A risk-management module that determines risk percentage, lot size, and stop-loss/take-profit levels

In this way, the EA separates “where to enter,” “which situations to skip,” and “how much risk to take,” rather than relying on a single indicator. This is one of the reasons it feels more structured than a basic indicator-only EA.

Long Bias and Market-Regime Dependence

Both the forward and backtests show that Pivot Killer is primarily a long-side EA. When gold is trending up, the breakout entries and position building can generate significant profits. In contrast, during downtrends or choppy ranges the EA often takes very few trades or none at all.

Because of that, the strategy:

- Works well as a way to capture gold’s long-term bullish bias

- Can produce periods with almost no trading or prolonged stagnation when gold enters a long correction phase

It is therefore better suited to traders who are happy to “wait patiently and capture only the favorable regimes” rather than those who want constant action.

Risk Profile: Small-Loss/Large-Profit, No Grid, No Martingale

The developer explicitly states that Pivot Killer does not use grid or martingale, and this is supported by the forward and backtest behavior:

- The number of open positions is limited, with no sign of unlimited averaging down in one direction.

- Each trade has a clearly defined stop loss, keeping losses relatively small.

- Take-profit targets are wider than stop losses, so one large winner can compensate for multiple small losses.

As a result, the EA can remain profitable even with a modest win rate, thanks to its asymmetric risk–reward design.

Drawdowns tend to appear as gradual declines during strings of losing trades, rather than the sudden crippling drawdowns typical of aggressive grid systems. As long as lot size and acceptable loss are set sensibly in advance, the overall account-blow-up risk is relatively manageable.

Key Strengths and Caveats from a Logic Perspective

From the standpoint of trading logic, the main points of Pivot Killer can be summarized as:

- Breakout-based entries focus on periods of strong movement, reducing unnecessary trades.

- The combination of three modules (entry, filters, risk management) gives it a more consistent, rule-based structure than simple indicator EAs.

- The strong long bias makes it highly compatible with a long-term bullish view on gold.

- On the other hand, during downtrends and ranges trading activity can dry up almost completely, which may frustrate traders who expect constant positions.

In short, Pivot Killer can be described as a breakout EA designed to capture gold’s bullish bias using a small-loss/large-profit, non-martingale approach.

Anyone using it should understand that results will vary significantly with market regime and should fit it into their portfolio according to their risk tolerance and overall strategy mix.

Overall Evaluation and Summary

Both the forward and backtests confirm that Pivot Killer is a breakout EA aiming to exploit gold’s bullish bias with a small-loss/large-profit profile. However, the current forward history is short, so there is not yet enough data for a final verdict. With that caveat in mind, here is a summary of our current view.

Strengths

- Asymmetric risk–reward: The system is designed so that one winner can cover multiple losers, even with a modest win rate.

- No grid / no martingale: It avoids dangerous averaging-down structures and uses explicit stop losses on each trade.

- Breakout-based with fewer unnecessary trades: It enters mainly when price is moving, rather than being in the market all the time.

- Backtest consistent with the concept: The 20-year backtest shows the same small-loss/large-profit, long-bias behavior and strong performance in bullish phases.

- Risk is easy to visualize: With fixed-lot backtests, you can gauge risk by looking directly at the lot size and maximum equity drawdown in dollars.

Points to Watch

- Short forward history: The live signal currently covers only a few weeks and a few dozen trades, which is not enough to assess long-term edge.

- Strong long bias: In gold downtrends or extended ranges, the EA may trade very little and the balance can stagnate.

- Backtest sensitivity to lot and balance: Do not rely only on relative drawdown percentages; always evaluate risk as “your lot size × maximum equity drawdown in dollars.”

- Heavy backtests: Long H1 gold backtests can take over an hour, but you should still run them in your own environment to see broker-specific differences.

Who Is This EA For?

- Traders who assume a long-term bullish trend in gold and want to capture only the favorable regimes.

- Those who want to avoid the “single-blow-up risk” of grid/martingale systems and instead add a small-loss/large-profit strategy to their portfolio.

- System traders who care more about long-term expectancy and robustness than about having positions open at all times.

Provisional Forex Robot Lab Verdict

- Logic transparency: The overall structure—breakout entries, asymmetric risk–reward, no martingale—is clear, with relatively little black-box feel.

- Robustness: With proper position sizing, it is easier to manage than grid-based EAs, though its strong long bias means results are highly market-dependent.

- Reproducibility: Backtest and forward behavior are broadly aligned with the stated concept, but the short forward history means continued monitoring is necessary.

In conclusion, Pivot Killer is best described as an EA whose concept is appealing but whose long-term live track record is still insufficient. If you are interested, avoid jumping straight into large lots. Instead, run your own backtests and demo / small-size forward tests with your broker, and carefully observe how the system behaves as market conditions change.

The EA does not use grid or martingale, and each trade has a clearly defined stop loss. However, it carries a strong long bias, so there is still downside risk if gold experiences a sharp sell-off. Be especially careful when increasing the lot size, as drawdowns will almost scale proportionally.